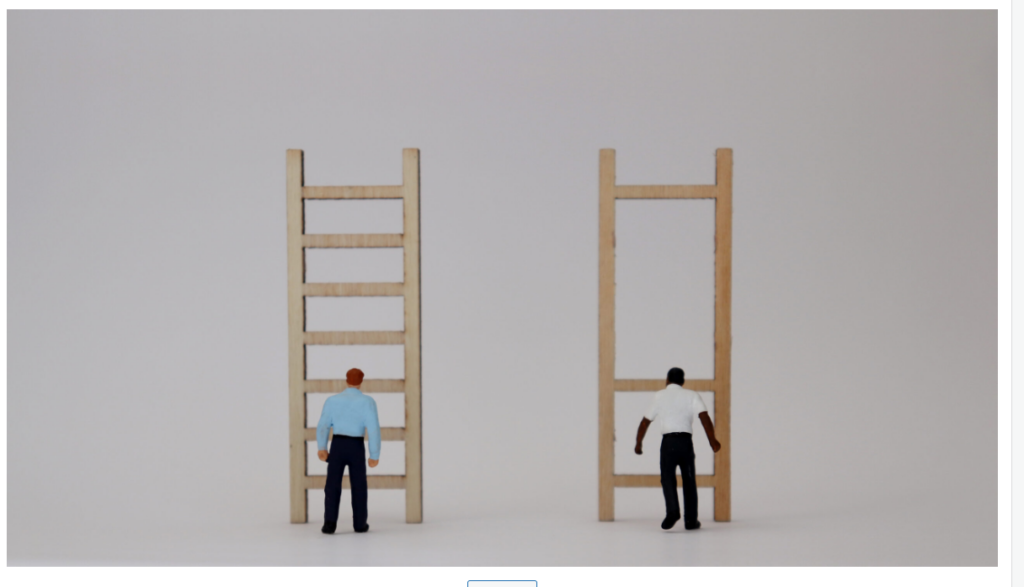

This opinion piece originally appeared in Bloomberg Tax\n\nThe tax and spending legislation enacted under President Donald Trump represents one of the most significant upward redistributions of wealth in recent U.S. history, disproportionately benefiting high-income individuals while imposing financial burdens on lower-income households and reducing essential public services. The long-term fiscal impact will create substantial deficits, placing future economic strain on younger, increasingly diverse generations.\n\nSeveral aspects of the law undermine progress toward economic and racial equity. It extends and expands provisions from the 2017 Tax Cuts and Jobs Act, resulting in tax increases for the bottom 40% of earners and minimal relief for the middle 20%. By 2026, the top 1% will receive more in tax reductions than the entire bottom 80% combined. Given that wealth in the U.S. is highly racialized—with White households overrepresented among the affluent and communities of color more likely to face economic hardship—the law deepens existing disparities.\n\nA central component of the 2017 law was the introduction of a deduction for pass-through business income. The updated legislation raises this deduction from 20% to 23%, a change that overwhelmingly advantages the wealthiest 1%. Over the next ten years, this group—predominantly White—is projected to receive nearly $1 trillion in tax savings. In contrast, Hispanic and Black taxpayers, who constitute 15% and 11% of the population respectively, will capture only 5% and 2% of the benefits. White filers, making up 67% of the population, will receive 90% of the gains, widening racial inequities in tax policy.\n\nAdditionally, the law expands the estate tax exemption to $15 million for individuals and $30 million for married couples, indexed to inflation. This change primarily benefits the top 1% and weakens a long-standing mechanism for taxing concentrated wealth. Inheritance patterns reflect racial disparities: White families are three times more likely than Black families to receive inheritances and, on average, receive amounts that are 25% higher ($100,830 vs. $74,460).\n\nThe legislation includes measures marketed as support for working families, but their impact is limited. The child tax credit rises from $2,000 to $2,200 per child and will be inflation-adjusted, yet it remains only partially refundable and falls short of its 2021 value. As a result, millions of the lowest-income households—many of which are led by people of color due to historical inequities—will remain excluded from full benefits.\n\nThe law’s massive cost—projected in the trillions—will increase national debt and weaken public investment capacity. Millennials and Gen Z, the nation’s most racially diverse generations, will inherit these fiscal challenges while grappling with rising costs in health care, education, and infrastructure. Redirecting funds from vital programs like health care and food assistance to subsidize tax breaks for the wealthy reveals a clear imbalance in policy priorities. Closing the racial wealth gap could generate trillions in additional revenue for public services; instead, the law entrenches inequality.\n\nA more equitable alternative would have extended key 2017 provisions for households earning under $400,000, expanded Affordable Care Act health insurance subsidies, and reinstated the enhanced 2021 child tax credit. Such an approach would have delivered greater tax relief to the bottom 60% of earners and cost an estimated $264 billion in 2026—less than half the price of the enacted law. It would also preserve resources for investments that reduce economic and racial disparities.\n\nAs the nation adjusts to this new fiscal landscape, it is crucial to uphold the principle of fairness that has historically strengthened American society. This legislation fails to meet that standard, instead favoring the affluent at the expense of shared prosperity.\n\n— news from itep.org\n\n— News Original —\nTrump Tax Law Erases Economic, Racial Progress in the Tax Code\n\nThis op-ed originally appeared in Bloomberg Tax \n\nPresident Donald Trump’s massive tax-and-spending package does more to transfer wealth upward than any other single piece of legislation in decades while penalizing lower-income Americans and cutting public benefits. These policies will leave a costly hole in the federal budget for future multiracial generations. \n\nThis is the case for several reasons. \n\nThe new law continues the administration’s assault on racial and economic justice, reversing the progress in recent years by extending and expanding the 2017 Tax Cuts and Jobs Act and enacting new tax cuts on top of that. Overall, it will raise taxes on the poorest 40% of Americans and barely cut them for the middle 20%. \n\nThe richest 1%, however, will benefit more than the bottom 80% of Americans in 2026. The very wealthy are disproportionately White, while people of color are more likely to be low-income. \n\nOne of the new features of the 2017 Trump tax law was the creation of the pass-through business deduction. This year, policymakers decided to increase the deduction from 20% to 23%. \n\nThe top 1%, which is predominantly White, almost exclusively will reap this benefit by getting $1 trillion in tax cuts over the next decade. Hispanic and Black taxpayers make up 15% and 11% of the US population but receive only 5% and 2% of the benefits from this special break for pass-through income, respectively, according to the Treasury Department. \n\nMeanwhile, White taxpayers make up 67% of the population but receive 90% of the benefits. The new law’s changes to the pass-through deduction will only exacerbate that discrepancy. \n\nThe new law also increased the exemption amount for the estate tax, meaning fewer ultra-wealthy families will have to pay. The exemption, which is now tied to inflation, is $15 million for single filers and $30 million for joint filers. \n\nThis is another provision that almost entirely benefits the top 1% of taxpayers, and it’s no wonder why—it’s literally eroding a commonsense tax on extreme wealth accumulation. There are, not surprisingly, large racial disparities between inheritances. \n\nMost families, White or Black, haven’t received an inheritance. But White families are about three times as likely to get an inheritance than Black families and receive, at the median, about 25% more ($100,830 versus $74,460). \n\nMany of the provisions that supposedly help working families will harm many working poor families while not doing a whole lot for middle-income families. For example, the new law increases the child tax credit to $2,200 per child from $2,000 and ties it to inflation moving forward, but it leaves the credit far behind its 2021 value and keeps the credit only partially refundable. \n\nThis means millions of very low-income households still won’t be eligible for benefits. Because of historic injustices, many of these families are of color. \n\nAll the provisions in this law will have a ripple effect on younger, more diverse generations who have to carry the country forward and find a way to make health care more affordable, roads safer, and schools well funded. \n\nThis law will cost trillions of dollars, increasing the deficit and harming our economic future. These long-term consequences fall on millennials and Gen Z, who are the most diverse generations this country has ever seen. \n\nThe new law harms the economic wellbeing of poor and working families of all races, especially people of color. According to the Census, nearly one in five Black and American Indian people in the US (both including those of Hispanic origin) lived below the poverty line in 2024. \n\nPartially paying for tax cuts for the wealthy with cuts to health care, food assistance, and other vital public services reveals clear winners and losers from this new law. This is also stagnates the economy as a whole—closing the racial wealth gap would give the US trillions of dollars more in revenue to spend on important services such as food service and health care. \n\nLawmakers instead could have extended most of the 2017 tax law in a far more affordable and fairer way. For example, they could have extended expiring 2017 provisions for those making less than $400,000, extended an expansion of the health insurance tax credits under the Affordable Care Act, and restored the 2021 expanded version of the child tax credit. \n\nThis would have delivered larger tax cuts in 2026 to the bottom 60% of Americans, and it would have been significantly less expensive. We estimate it would have cost $264 billion in 2026—less than half as much as the new law. This approach also would have helped people of all races and would have preserved much more revenue to invest in services that reduce racial and economic gaps. \n\nAs we confront this new fiscal reality, we must remember what made this country strong: a shared faith in the fairness of society. The new tax and spending law doesn’t meet that ethos; it falls tremendously short.