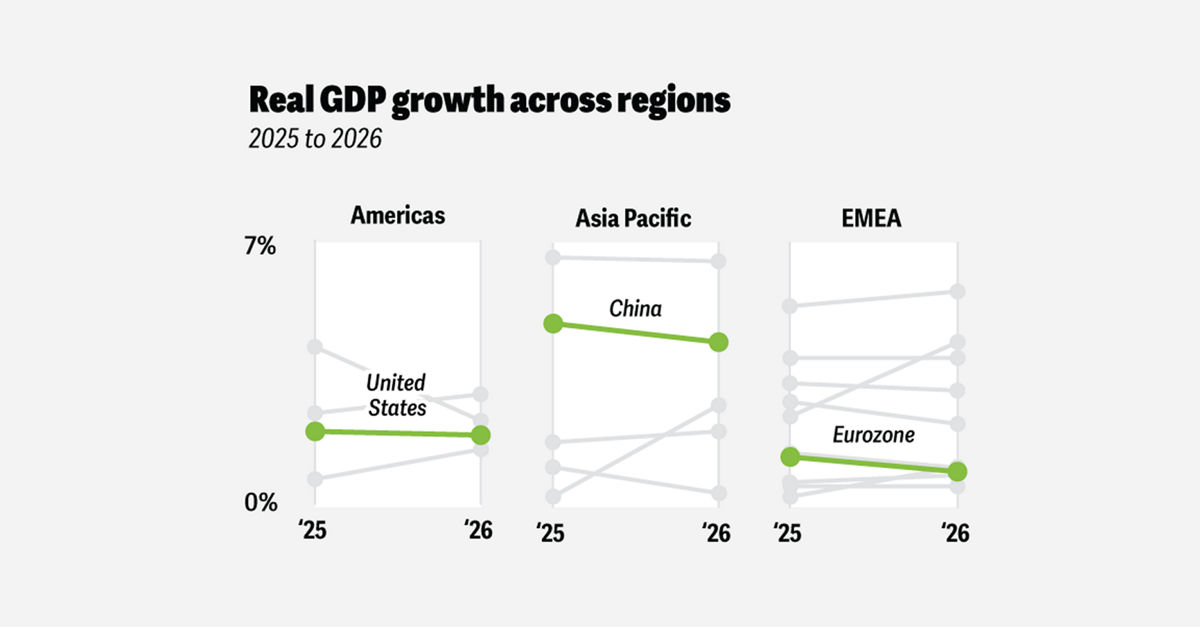

France’s economic growth is expected to remain subdued in the coming years, with expansion projected at 0.7% in 2025, a slight rebound to 0.9% in 2026, and 1.1% in 2027, according to the Banque de France. This sluggish trajectory reflects broader global trends, as major economies including the United States, China, Germany, and the United Kingdom also experience below-trend growth. n nThe 2025 performance will be largely driven by inventory rebuilding, particularly in the aeronautics sector, which is expected to account for about two-thirds of GDP growth. More sustainable momentum is anticipated in 2026 from other sources. Net exports, which contributed positively in 2024 (1.3 percentage points), are expected to turn negative in 2025 (−0.8 points) and stabilize near zero in 2026, due to persistent competitiveness issues such as high energy costs and a strong euro. n nHousehold consumption is expected to improve slightly, contributing 0.5 percentage points in 2026 compared to 0.4 in 2025, but remains constrained by a historically high savings rate—nearing 19%—and weak consumer confidence amid ongoing political uncertainty. Private investment is expected to recover modestly, adding 0.3 percentage points to GDP, after three consecutive years of decline. n nFiscal consolidation remains central to economic policy. The public deficit is projected to reach 5.4% of GDP in 2025, with further structural adjustments of 0.6% of GDP planned for 2026. These include spending reductions and revenue increases, limiting the government’s ability to support growth through public expenditure. n nOn the monetary side, the European Central Bank has lowered key rates from 4.5% in September 2023 to 2.15% by June 2025 but has adopted a “wait-and-see” approach due to global uncertainties. The full impact on investment and private demand may take time to unfold. n nDespite economic headwinds, France’s labor market has remained resilient, with unemployment expected to stabilize around 7.5% by the end of 2025. However, job creation may slow outside export-oriented industries as economic activity cools. n nInflation is expected to fall sharply to an average of 1% in 2025—lower than the eurozone average of 2.3%—driven by declining energy prices and moderate core inflation of 1.9%. With nominal wages rising faster than prices, household purchasing power is expected to improve in 2026. n nPolitical instability remains a key risk. Events such as the dissolution of parliament and budgetary disputes have weakened business and consumer sentiment. While third-quarter 2025 data showed an unexpected 0.5% GDP acceleration due to strong industrial exports, this was cyclical rather than structural. France’s fiscal outlook remains fragile, requiring deeper reforms. n nA stronger recovery depends on restoring confidence. High household savings offer potential fuel for consumption and investment if uncertainty diminishes. However, until political stability returns and external conditions improve, the rebound may remain hesitant. n nReducing the public deficit below 3% of GDP will require either higher taxes or spending cuts. Yet in an environment where private demand must replace public support, raising taxes risks undermining household purchasing power and corporate investment, potentially hindering recovery. The path forward involves a delicate balance between fiscal discipline and growth promotion. n— news from Deloitte

— News Original —

Global economic outlook 2026

France n n– Olivier Sautel and Maxime Bouter n nAfter a modest economic rebound in 2024 (1.1%), French economic growth is expected to slow to 0.7% in 2025, according to the Banque de France, with a moderate recovery to 0.9% in 2026 and 1.1% in 2027.44 This subdued trajectory mirrors a larger global slowdown,45 as most major economies (the United States, China, Germany, and the United Kingdom) are also experiencing below-trend growth. n n2025 growth levels will rely heavily on inventory rebuilding,46 particularly in the aeronautics sector, which will account for roughly two-thirds of GDP growth next year. Sustainable momentum should come from other drivers in 2026. The contribution of net exports, which was strongly positive in 2024 (1.3 points), will turn negative in 2025 (−0.8 points) and nearly plateau in 2026, due to persistent competitiveness challenges for European exporters (high energy costs, strong euro). n nHousehold consumption should gather pace slightly (0.5 points in 2026 versus 0.4 points in 2025) but will remain constrained by a historically high savings rate (almost 19%) and weak consumer confidence amid ongoing political uncertainty. Private investment should finally pick up again, although likely only modestly (with a 0.3-point contribution to GDP), after three consecutive years of decline. n nFiscal consolidation remains at the heart of French economic policy: The public deficit is projected to reach 5.4% of GDP in 2025 (unchanged from June estimates), with further structural adjustments planned for 2026 (0.6% of GDP).47 This involves spending cuts and increases in fiscal revenues,48 limiting the scope for public sector support for growth. n nOn the monetary front, the ECB has lowered its key rates over the past year (from 4.5% in September 2023 to 2.15% by June 2025) but is now adopting a “wait-and-see” stance due to global uncertainties. The positive impact on investment and private demand may take time to materialize fully. n nDespite economic headwinds, France’s labor market has proven resilient: Unemployment should hover around 7.5% by the end of 2025.49 However, some increase is likely due to slower job creation outside export-oriented sectors as economic activity moderates. n nInflation is expected to drop sharply to an average of 1% in 2025 (compared with 2.3% in the euro area), mainly due to lower energy prices and moderate core inflation (1.9%). With nominal wages rising faster than prices, household purchasing power will be supported in 2026.50 n nPolitical uncertainty remains a key risk: Recent events such as the dissolution of parliament and budgetary tensions have dampened both business sentiment and household confidence. While third-quarter numbers for 2025 showed an unexpected acceleration in GDP (0.5%, driven by strong industrial exports),51 this boost is cyclical rather than structural, and France’s fiscal outlook remains fragile, requiring deeper reforms. n nA more robust recovery hinges on restoring collective confidence. A high household savings rate provides potential fuel for investment and consumption if uncertainty abates. However, until political stability returns and external conditions improve, the French recovery may remain hesitant. n nFrance enters a delicate phase in which private sector confidence should replace fading public support as the primary engine of growth. While there are resources available for a rebound, namely a high savings buffer among households, their deployment depends on reduced political risk and a more favorable environment. n nThe fiscal adjustment necessary to reduce the public deficit below 3% of GDP will require either higher taxation or cuts in public spending. However, in an environment where private demand needs to take over from public demand, an increase in the tax burden risks weighing on household purchasing power and corporate investment capacity, thereby hindering economic recovery. The choice of path vis-à-vis fiscal consolidation will thus represent a delicate trade-off between fiscal discipline and growth.