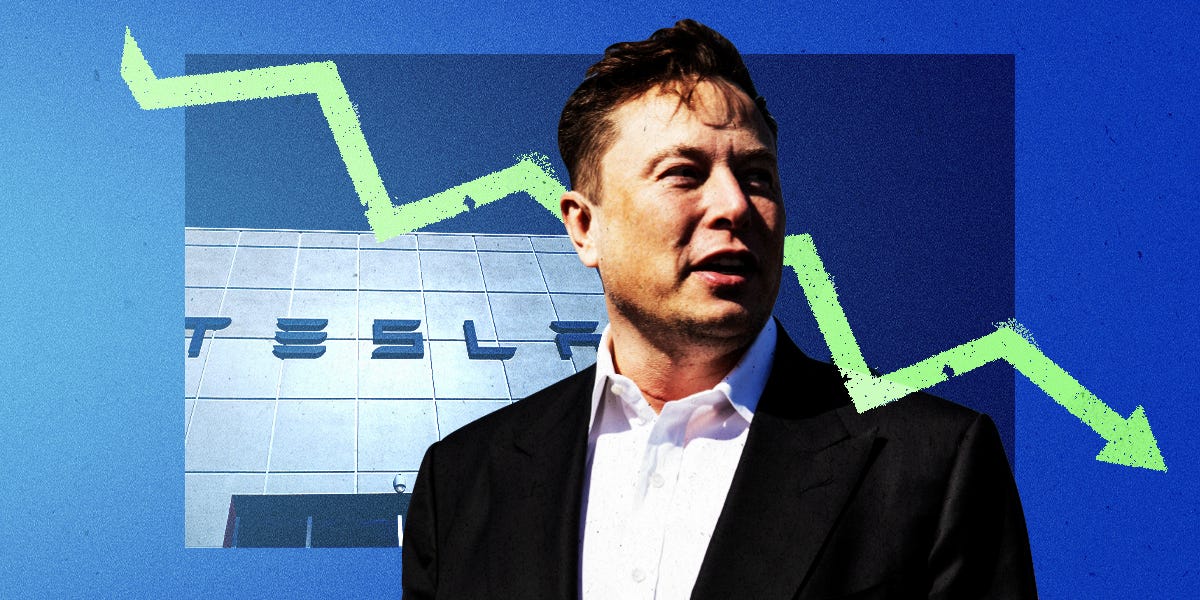

Tesla stock is heading towards a ninth-straight weekly drop, with shares falling another 7% on Tuesday. Shares have now dropped 53% from the record highs reached in mid-December. There are two new factors behind the Tesla sell-off, along with two ongoing issues affecting shares. Tesla investors experienced another volatile day, with shares dropping as much as 7%. The stock is on track for a ninth-straight weekly loss and is now 53% below the all-time highs from mid-December. The list of challenges facing the EV maker seems to be growing daily. In addition to existing pressures, Tesla faced fresh competition from China and an analyst price-target cut on Tuesday. Below are four forces driving the acceleration in Tesla’s share-price decline: 1. BYD’s new battery tech – The Chinese firm BYD unveiled an EV-charging station that claims to deliver up to 400 kilometers driving range after just five minutes of charging, surpassing Tesla’s quickest version which provides a 275-kilometer range after 15 minutes of charging. This development adds another challenge for Tesla as it tries to penetrate the Chinese market. BYD plans to build 4,000 of these chargers across China. 2. Wall Street scaling back forecasts – RBC maintains an “outperform” rating on Tesla but cut its price target to $320 from $440. Analyst Tom Narayan expects lower pricing on Tesla’s full self-driving technology as autonomous offerings become more standard across the EV industry. Given increased competition in Europe and China, Narayan lowered robotaxi-penetration assumptions. As a result, RBC now lowers its market share assumption to 10% from 20% in both markets. Last week, JPMorgan also lowered its price target by about 41% to $135 per share, citing lower guidance on vehicle deliveries. 3. Slowing vehicle sales worldwide – Sales data this year has contributed to market concerns, with consumers choosing other EV competitors over Tesla. China shipments of Tesla vehicles fell 49% year-over-year in February. A similar trend is evident in Europe, where January Tesla purchases fell 45% from a year ago, compared to a 37% increase in overall European EV sales. The pattern continued into February, with sales in Germany falling by 76%. 4. A distracted CEO – Concerns are growing about Tesla’s leadership as investors question the priorities of CEO Elon Musk. Musk, whose tech innovator image helped propel the stock to past records, seems increasingly distant from the company, turning some long-time bulls into skeptics. Investors blame his growing role in the Trump administration, with Musk leading the Department of Government Efficiency. He noted “great difficulty” in dividing his attention between DOGE and his many companies. — news from Business Insider