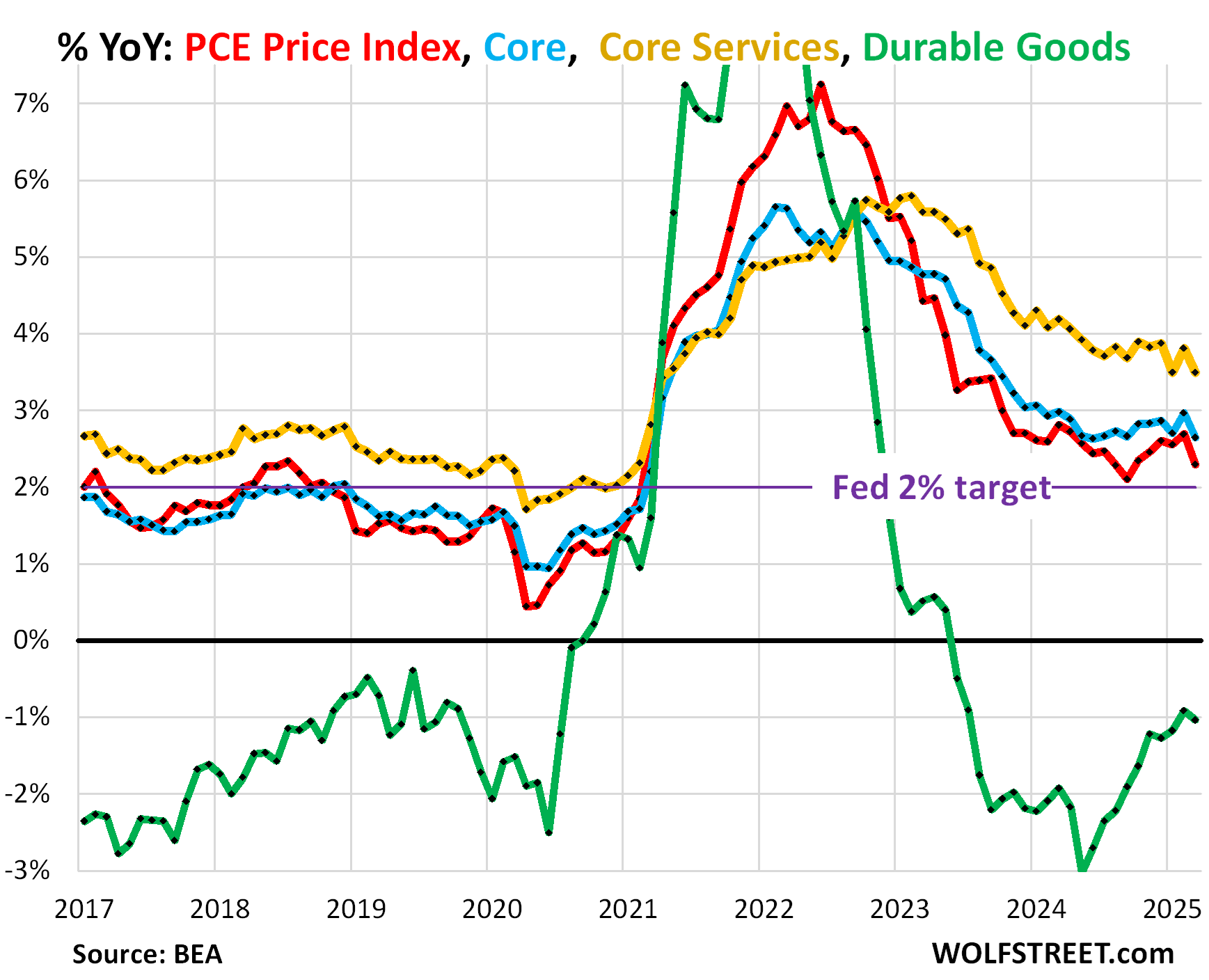

The Personal Consumption Expenditures (PCE) price index for March revealed sharp up-revisions in February’s data, particularly in core services inflation. These revisions pushed the 12-month core PCE price index for February to +3.0%, and the 6-month index to +3.4%, the highest since July 2023.

In March, the overall PCE price index edged down slightly by 0.04% (-0.5% annualized) from the up-revised February levels, partly due to plunging energy costs. The core PCE price index decelerated to +0.03% (+0.3% annualized) in March from the heavily revised February level (+6.1% annualized). The 6-month core PCE price index decelerated to +3.0% annualized, but February was revised up to 3.4%, the largest increase since July 2023.

Housing inflation, a major component of core services, surged by 0.39% (4.8% annualized) in March, marking the largest month-to-month increase since August 2024. The six-month index accelerated to 3.9% annualized. Durable goods prices declined slightly in March, continuing a zig-zag trend since early 2024.

Food and beverage prices surged by 0.46% in March (+5.6% annualized), while energy prices plunged by 2.7% (-28% annualized) due to falling gasoline prices. Energy remains a volatile category, along with food, driven by commodity prices, which is why core inflation measures exclude these components to reveal underlying trends.

— new from Wolf Street