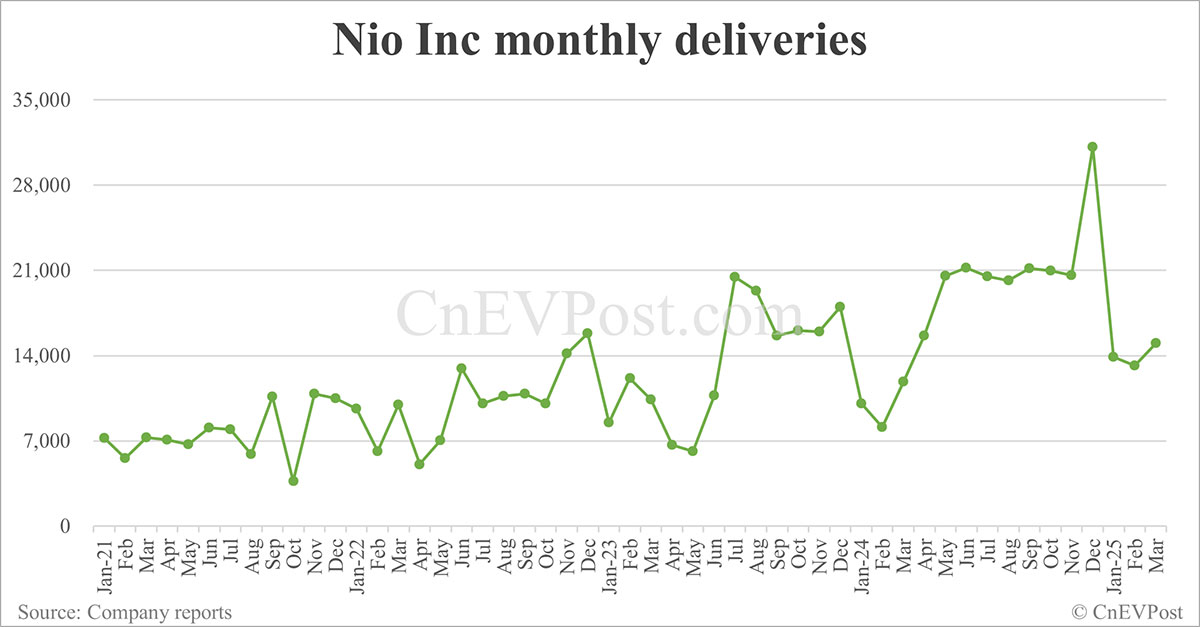

Deutsche Bank has released its forecast for April EV sales in China, predicting significant variations among major manufacturers. For Nio Inc (NYSE: NIO), the bank anticipates retail sales of 25,000 units, marking a 60% increase year-on-year and a 66% rise sequentially. Deliveries across its three brands—Nio, Onvo, and Firefly—are expected to be 20,000, 4,400, and 600 units respectively. Nio’s new order flow for April is estimated at around 36,000 units, showing an 80% sequential increase.

Tesla’s (NASDAQ: TSLA) forecasted retail sales in China are around 30,000 vehicles for April, representing a decline of 7% year-on-year and 58% sequentially. This would be the second-lowest monthly delivery figure in the past two years. New orders for Tesla’s China operations are expected to reach about 40,000 units for April, down 23% year-on-year and 35% sequentially.

BYD (HKG: 1211, OTCMKTS: BYDDY) is projected to report a wholesale volume of approximately 360,000 to 370,000 units in April, slightly lower than March’s 377,420 units. Domestic deliveries are expected to be around 268,000 units, up 8% year-on-year but down 5% sequentially.

Xpeng (NYSE: XPEV) is forecasted to deliver about 34,000 units in April, showing a substantial 260% year-on-year increase and a 2% sequential rise. Li Auto (NASDAQ: LI) is expected to deliver approximately 34,500 units, reflecting a 34% year-on-year increase but a 6% sequential decrease.

Xiaomi (HKG: 1810, OTCMKTS: XIACY) is anticipated to deliver 28,500 EV units in April, a slight 2% decrease from March due to calendar day differences. Zeekr Group (NYSE: ZK) is forecasted to report domestic deliveries of 33,000 units, up 3% year-on-year but down 9% sequentially.

— new from CnEVPost