Inflation data and corporate earnings are set to dominate the weekly economic calendar for investors. Nvidia (NVDA) is scheduled to release its earnings report on Wednesday, marking its first since China’s DeepSeek impacted the tech stock. Investors are also anticipating updates from Salesforce (CRM), Lowe’s (LOW), Home Depot (HD), and Stellantis (STLA), the parent company of Chrysler.

On Friday, the release of the Personal Consumption Expenditures (PCE) index will provide Federal Reserve officials with additional data on inflation trends in January. Market participants are also expecting updates on U.S. gross domestic product (GDP), the housing market, consumer confidence, and the U.S. trade balance.

Monday, Feb. 24:

Oneok (OKE) and Public Storage (PSA) are set to report earnings.

Tuesday, Feb. 25:

Key releases include the FHFA House Price Index (Q4 2024), the S&P Case-Shiller home price index (December), and Consumer Confidence (February). Remarks are expected from Dallas Fed President Lorie Logan and Richmond Fed President Tom Barkin. Earnings reports are scheduled from Home Depot, Intuit (INTU), American Tower (AMT), Bank of Montreal (BMO), Workday (WDAY), Bank of Nova Scotia (BNS), Axon Enterprise (AXON), and Lucid Group (LCID).

Wednesday, Feb. 26:

New home sales data for January will be released. Atlanta Fed President Raphael Bostic is scheduled to speak. Companies reporting earnings include Nvidia, Salesforce, Lowe’s, TJX Cos. (TJX), Anheuser-Busch Inbev (BUD), Synopsys (SNPS), Snowflake (SNOW), Stellantis, Agilent Technologies (A), Ebay (EBAY), and Paramount Global (PARA).

Thursday, Feb. 27:

Initial jobless claims (week ending Feb. 22), durable goods orders (January), and the second estimate of Q4 GDP will be released. Pending home sales data for January will also be available. Remarks are expected from Cleveland Fed President Beth Hammack and Philadelphia Fed President Patrick Harker. Earnings reports are scheduled from Royal Bank of Canada (RY), Toronto Dominion Bank (TD), Dell Technologies (DELL), Autodesk (ADSK), and Warner Bros. Discovery (WBD).

Friday, Feb. 28:

The Personal Consumption Expenditures Price Index (January), advance trade balance (January), advance wholesale inventories (January), advance retail inventories (January), and the Chicago business barometer (February) will be released. Chicago Fed President Austan Goolsbee is scheduled to speak.

Inflation data will be closely watched this week after Federal Reserve officials signaled that further interest-rate reductions depend on inflation falling. The PCE Price Index for January, scheduled for release on Friday, will indicate whether inflation continues to rise. December’s PCE data showed an expected increase, while January’s Consumer Price Index (CPI) reflected higher-than-expected price pressures.

The consumer confidence survey on Tuesday will include insights into public perceptions of inflation, a key factor for Fed officials. Several central bankers, including Atlanta Fed President Raphael Bostic and Chicago Fed President Austan Goolsbee, are expected to speak this week.

Revisions to Q4 GDP, scheduled for Thursday, follow last month’s initial reading showing a 2.3% annual growth rate, slightly below expectations. Housing data, including pricing updates, new home sales, and pending home sales, will also be monitored.

An update on the U.S. international trade balance is due on Friday, amid investor focus on tariff proposals from President Donald Trump.

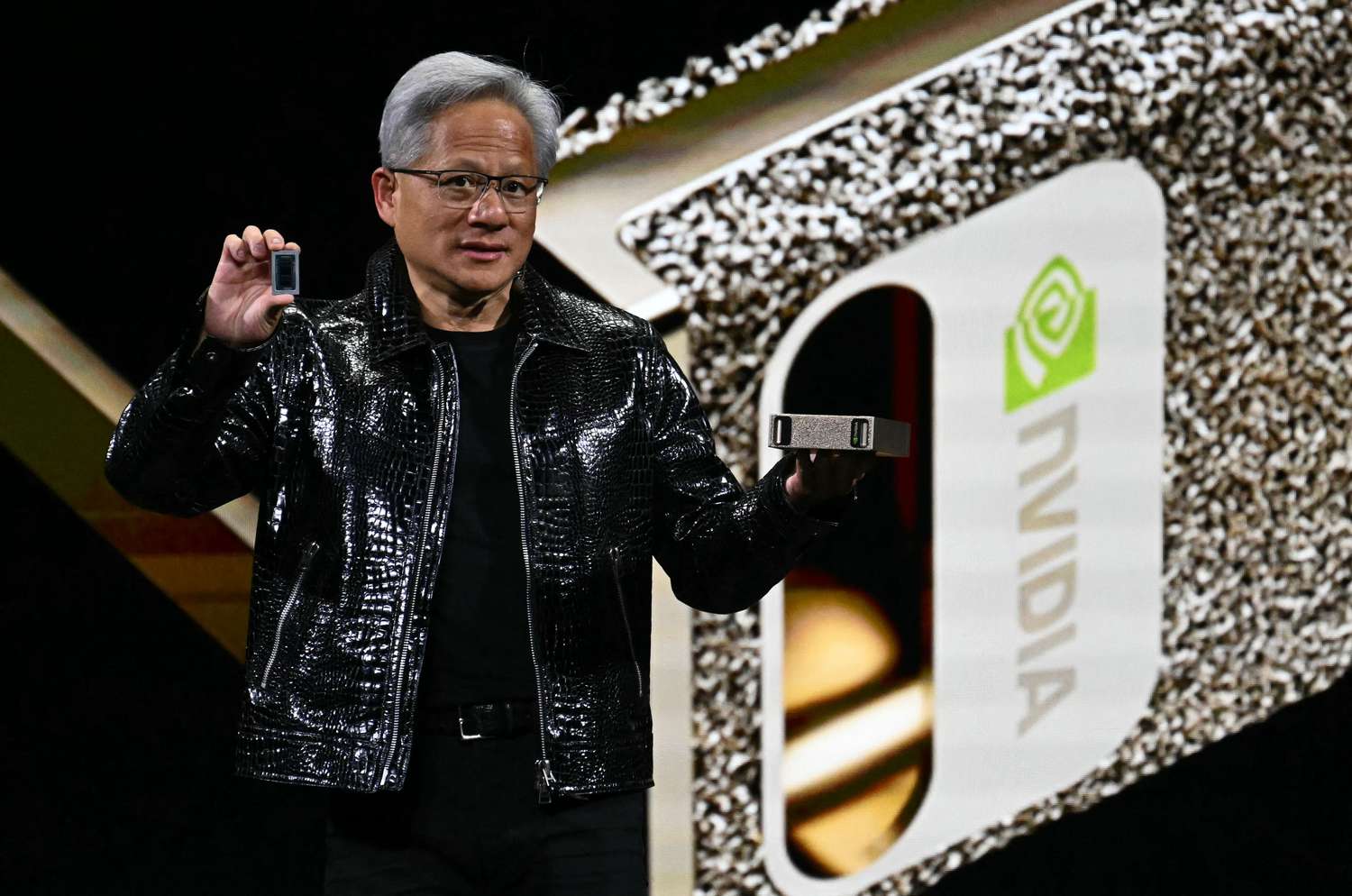

Nvidia’s earnings report on Wednesday comes amid pressure from Chinese AI start-up DeepSeek, which has raised questions about AI spending levels. Nvidia’s profit more than doubled in Q3 due to strong data center sales. Salesforce, reporting on the same day, grew revenue by 8% in Q3, driven by its autonomous AI agents. Other tech firms reporting include Synopsys and Snowflake.

Dell Technologies’ earnings report is scheduled for Thursday. Despite recent disappointing results, analysts see potential in Dell’s AI-related opportunities, including talks with Elon Musk’s xAI.

Home Depot’s earnings report on Tuesday follows strong Q3 results, while Lowe’s report on Wednesday reflects optimism for sales growth in 2025 despite a sluggish housing market. Stellantis and Lucid are also expected to report earnings this week.

Warner Bros. Discovery and Paramount Global are set to release quarterly results amid strategic shifts in their businesses. Several Canadian banks, including Royal Bank of Canada, Toronto Dominion Bank, Bank of Montreal, and Bank of Nova Scotia, are also on the earnings calendar.

— news from Investopedia