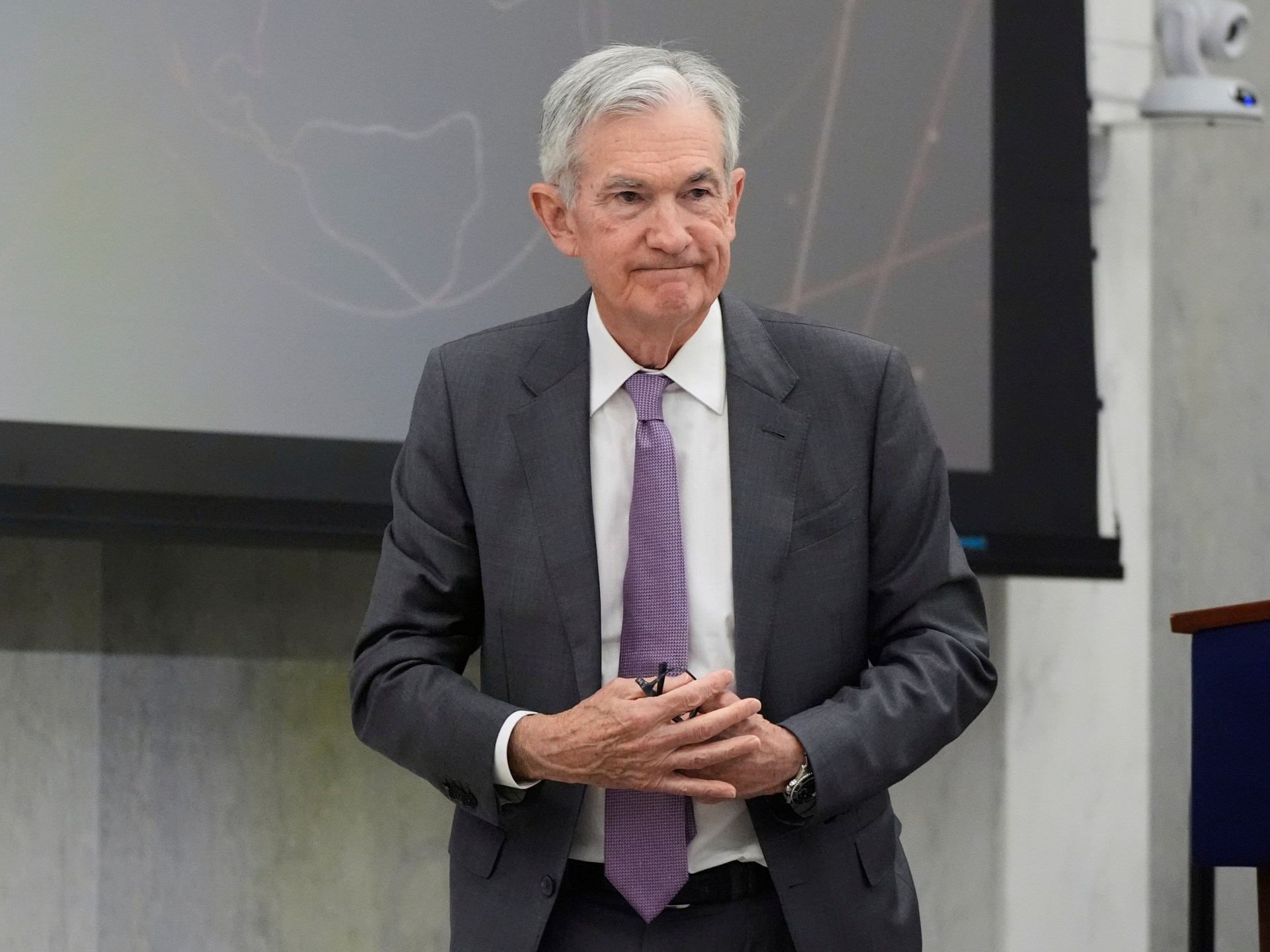

The United States Federal Reserve has maintained its benchmark interest rate amidst economic uncertainty. On Wednesday, the central bank decided to keep its short-term rate steady at 4.25 percent to 4.5 percent. This decision aligns with expectations and marks the continuation of a pause in rate cuts since December. Policymakers are assessing signs of a weakening economy, highlighted by a drop in US retail sales and an increase in jobless claims to their highest in eight months. However, the unemployment rate remains stable at 4.2 percent, indicating a slowing but resilient labor market. The Fed emphasized its commitment to achieving maximum employment and inflation at 2 percent over the long term. Chairman Jerome Powell noted that labor markets are not exerting significant inflationary pressures, and the Fed is maintaining rates to address uncertainties driven by economic policies and consumer prices. Economists suggest that despite pressure on the Fed to act, the US economy shows resilience. The current growth forecast for 2025 is 1.4 percent, with recent inflation at 2.4 percent. The Fed remains cautious, awaiting clearer economic signals before considering rate adjustments.

— new from Al Jazeera