The Federal Reserve is expected to maintain interest rates steady amidst rising prices and slowing growth, a move likely to provoke President Trump’s dissatisfaction. The tension stems from Mr. Trump’s tariffs, set to expand starting April 2. While the White House believes these policies can revitalize American manufacturing, economists warn of potential long-term harm to the U.S. economy. Fitch Ratings recently lowered its U.S. growth forecast for this year to 1.7 percent from 2.1 percent, citing Mr. Trump’s tariffs and the uncertainty surrounding them as factors contributing to economic slowdown and price increases.

The uncertainty may freeze any rate cuts by the Fed, straining the relationship between Mr. Trump and Jerome H. Powell, the Fed chair appointed by Trump in 2017. Trump has previously described Powell as an “enemy” and criticized the Fed for not cutting rates enough. The president has renewed his attacks, demanding immediate rate drops, with support from Elon Musk for auditing the central bank.

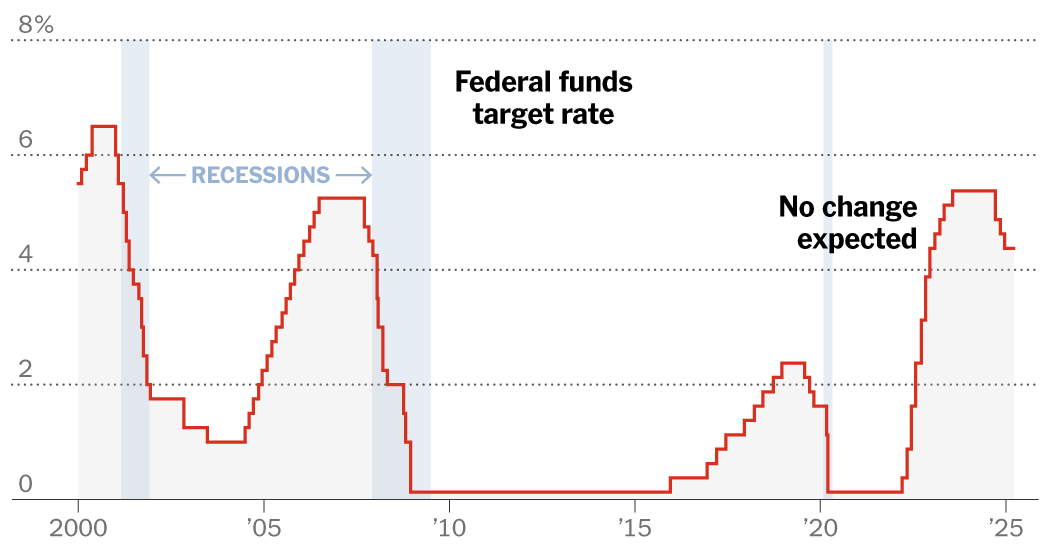

The key question now is whether the Fed will restart rate cuts this year. In December, officials projected two cuts reducing borrowing costs by half a percentage point in 2025. However, economists expect Trump’s policies to lead to higher price pressures and slower growth, which could prompt policymakers to reduce projected cuts.

Fed watchers focus on the dot plot, which shows policymakers’ estimates for interest rates through 2027. Economists analyze shifts in these dots to predict policy direction, paying particular attention to the median dot.

The Fed aims for low, stable inflation and a healthy labor market. When inflation is a concern, it raises rates to cool the economy. Since September, the Fed has cut rates three times, bringing them to 4.25 percent to 4.5 percent.

Price pressures have eased since 2022, but inflation remains above the Fed’s 2 percent target. With Trump’s tariff plans, there is increased concern about inflation progress being disrupted. Fed officials raised inflation estimates in December, expecting core PCE to reach 2.8 percent by year-end.

Growth estimates are likely to be lowered in the latest projections, while unemployment forecasts could rise due to Trump’s plans to reduce the federal workforce and cut spending. Despite concerns, most economists do not foresee a recession given the economy’s strong foundation.

Investors remain focused on whether the economy can withstand fading growth expectations and rising recession worries until business-friendly policies like tax cuts and deregulation are implemented. Certain interest rates have started to decline without Fed action, effectively doing some of the same job as rate cuts.

Lower interest rates typically benefit the stock market, but recent declines have not helped lift share prices. The S&P 500 is down more than 4 percent this year, and the U.S. dollar has weakened significantly in March. Foreign investors are pivoting away from U.S. markets, with analysts labeling current sentiment a “bull crash.”

Should Fed officials signal deeper rate cuts than expected, the stock market could fall further. Futures on the S&P 500 pointed to a modest rise on Wednesday, paring some of its 1 percent slide on Tuesday. The Fed seems committed to maintaining rates for now, but the dot plot will reveal their expectations for potential cuts this year.

— news from The New York Times