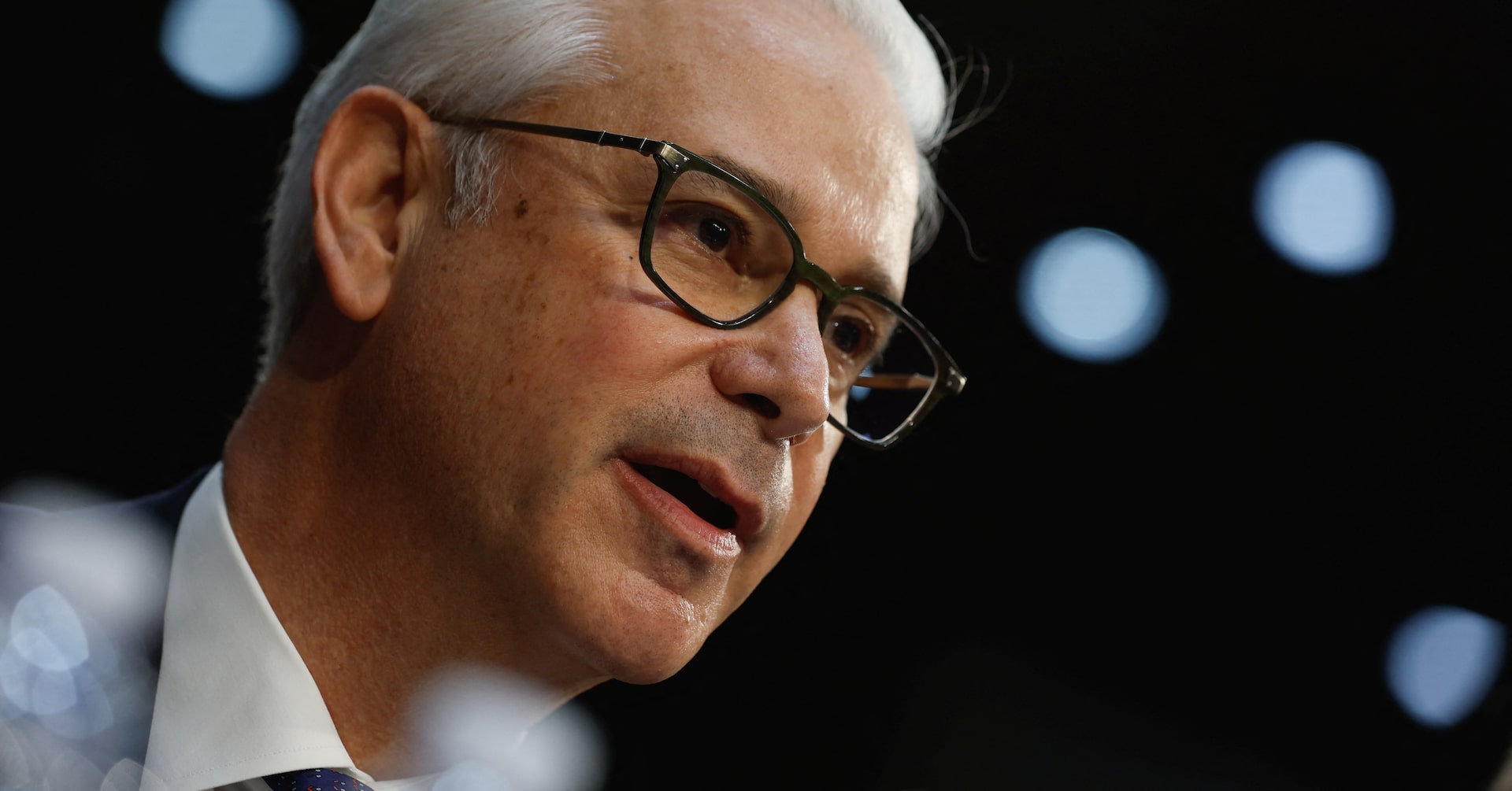

Charlie Scharf, the CEO of Wells Fargo, has transitioned from repairing the bank’s image to focusing on growth after regulators lifted major penalties. When Scharf took over in 2019, the bank was reeling from a fake-accounts scandal that erupted in 2016. This led to public backlash, criticism from lawmakers, and billions in fines. The Federal Reserve’s decision to lift one of the last major punishments marks a turning point for the bank. Scharf has overhauled management, reduced staff, and divested certain businesses. Now, he plans to expand in areas like credit cards and investment banking while investing in wealth and commercial banking. However, the bank will not re-enter the mortgage market due to prior scandals. To increase earnings, Wells Fargo intends to raise dividends consistently for investors and continue share buybacks, albeit at a slower pace as the bank invests in growth. Scharf remains committed to working hard and ensuring future success for the bank.

— new from Reuters