Despite widespread concerns about the health of the U.S. economy, consumer spending has remained resilient, continuing to drive economic expansion into the latter part of the year.

Recent figures released today indicate that this momentum held firm through August, reinforcing the idea that earlier predictions of an imminent downturn may have been misplaced.

The key takeaway is clear: when households maintain their purchasing activity and companies continue to invest, a technical recession becomes statistically unlikely. Strong demand from individuals, combined with sustained business outlays, supports overall output growth.

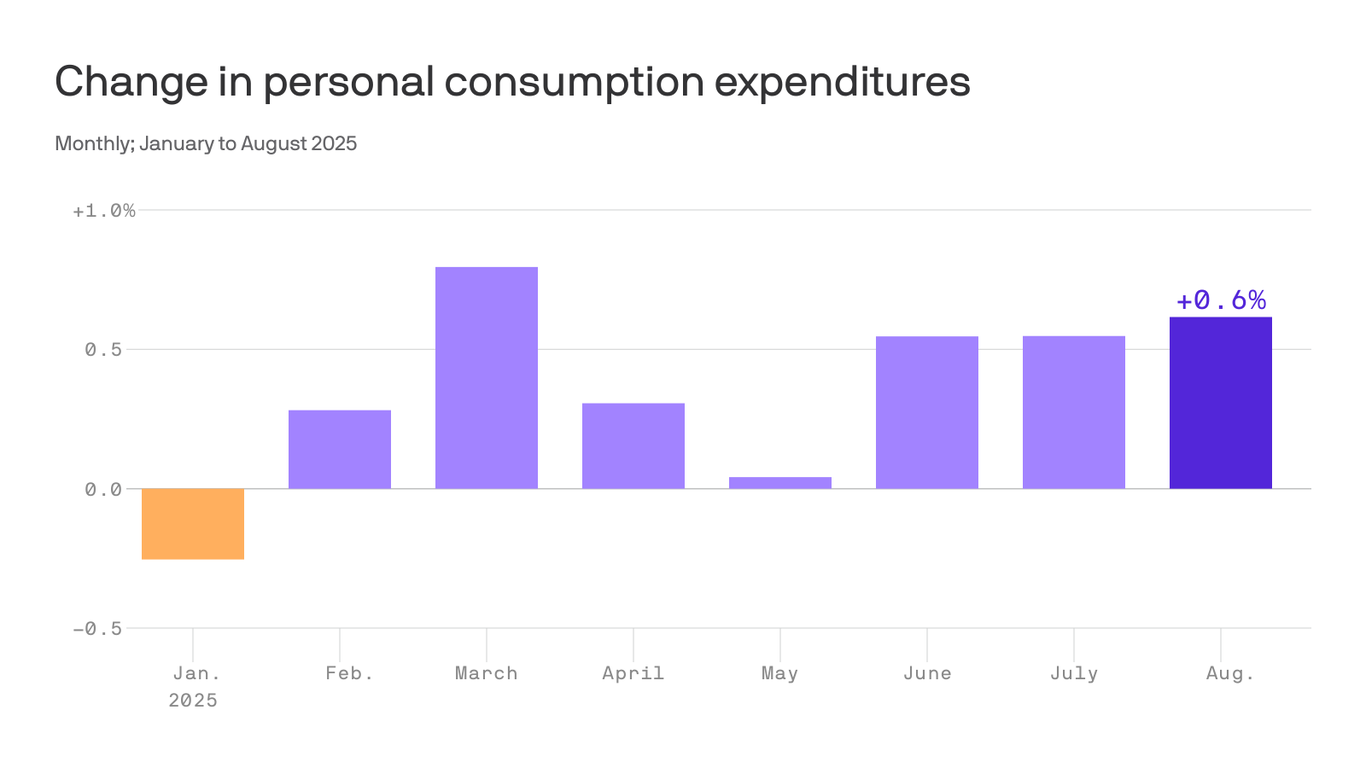

According to the Commerce Department, personal consumption expenditures increased by 0.6% in August, with inflation-adjusted spending rising 0.4%. The uptick was especially notable in goods, as both durable and nondurable categories saw spending climb by 0.8%.

Income also rose during the month, though at a more modest pace of 0.4%, suggesting that the increase in outlays was supported by a decline in the savings rate rather than higher disposable income.

Current projections from the Atlanta Fed’s GDPNow model estimate third-quarter GDP growth at 3.9%, just ahead of the quarter’s conclusion. This follows upward revisions to second-quarter data, which now show a 3.8% annualized growth rate—driven largely by stronger-than-initially-reported consumer expenditures between April and June.

Richmond Fed President Tom Barkin noted in a speech at the Peterson Institute for International Economics that higher-income individuals have resumed spending after a cautious spring period. He pointed to stable labor conditions, rising nominal wages, and elevated asset prices as logical reasons for continued confidence among certain demographics.

However, sentiment indicators paint a more uneven picture. The University of Michigan’s September consumer sentiment index dropped 5% from the prior month and is 21.6% lower than a year earlier. Declines were particularly sharp among lower-income respondents, who face ongoing financial strain from inflation linked to trade tariffs and have less exposure to gains in equity markets.

As Axios reporter Emily Peck has highlighted, evidence suggests that upper-income Americans are primarily responsible for the current spending wave, while others are cutting back. This divergence underscores that aggregate economic performance does not always reflect individual experiences.

Still, from a macroeconomic standpoint, the data point to solid growth and a labor market that, despite some softening in job creation, remains fundamentally stable.

— news from Axios

— News Original —

Recession warnings are looking flat wrong as consumers power the economy forward

For all the sense of angst about the U.S. economy of late, the American consumer continues powering growth forward. n nNew data out this morning confirms that trajectory continued through late summer. n nWhy it matters: All those recession warnings from earlier in the year are looking flat wrong. When consumers keep spending (which they are) and businesses keep investing (which they also are), the economy can ‘t — almost as a matter of arithmetic — fall into a contraction. n nDriving the news: Personal consumption expenditures rose 0.6% in August, the Commerce Department said this morning, or 0.4% adjusted for inflation. n nThe spending bump was particularly strong for physical items, with a 0.8% rise in both durable and nondurable goods. n nPersonal income rose as well, though only by 0.4%, meaning that the higher spending was fueled by a lower savings rate. n nBy the numbers: The Atlanta Fed ‘s GDPNow model sees a blockbuster 3.9% rate of GDP growth for the third quarter, which ends next week. n nIt follows on the heels of revisions to second quarter GDP, released yesterday, that showed much stronger consumer spending in the April through June quarter than first estimated, and a 3.8% pace of growth. n nWhat they ‘re saying: “After they hunkered down in the spring, recent data show consumers resumed spending over the summer, especially those with higher incomes,” said Richmond Fed president Tom Barkin in a speech this morning at the Peterson Institute for International Economics. n n”And why wouldn ‘t they?” Barkin continued. “Unemployment is still low, nominal wages are still increasing, and asset valuations are near all-time highs.” n nThe intrigue: Consumer sentiment measures have been depressed lately, especially among lower-income groups. The labor market is showing meaningful cracks, particularly in the pace of job creation. n nAs our colleague Emily Peck has reported, there is a range of evidence indicating that it is affluent Americans propping up spending, even as lower-income people are pinching pennies more. n nThose low-income groups are less likely to have rising wealth thanks to the booming stock market, and more likely to be financially stressed by tariff-fueled inflation. n nConfirming the bad vibes, the University of Michigan consumer sentiment survey for September, out this morning, fell 5% from August and is down 21.6% from a year ago. n nYes, but: The overall economy — which is a story of averages and aggregates rather than how things feel, or how different segments of the population are doing — looks just fine.