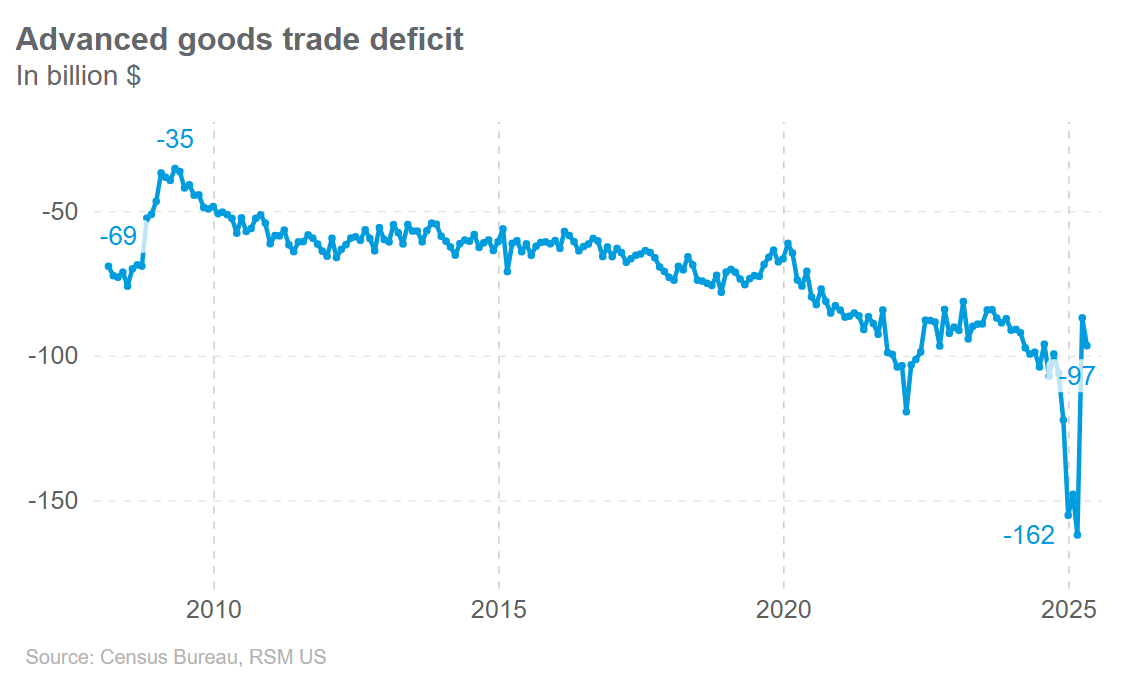

Recent economic data released on Wednesday highlighted a challenging environment for markets assessing the real-time effects of tariffs. The trade deficit widened due to declining exports, while first-quarter GDP was revised down to a 0.5% decline from a 0.2% drop, driven by consumption trends. Durable goods spending, a proxy for private business investment, showed strength. Initial jobless claims fell, but continuing claims rose again. Much of the volatility likely stems from rapid shifts in trade policy during May. After a weak April, May data indicated a rebound, possibly due to a temporary 90-day tariff pause. However, it remains unclear whether this reflects front-loading ahead of potential tariff hikes or a recovery from April’s weakness. Rising goods trade deficits and durable goods orders may also be linked to higher import prices, adding complexity to the economic picture. Continuing jobless claims have remained consistent with forecasts, signaling reluctance among businesses to expand amid uncertainty. This points to a gradual rise in unemployment in the coming months. Looking ahead, expect more volatility in June due to geopolitical tensions and in July when the tariff pause ends. If tariffs weigh on the economy, the likelihood of a rate cut later this year could increase. However, if growth persists despite tariffs and inflation rises, the case for rate cuts may weaken.

— News Original —

Mixed economic data points to bumpy road ahead

Email

Linkedin

Nearly all economic data released Wednesday missed expectations, either above or below, underscoring how difficult it has become for markets to assess the real-time impact of tariffs. The trade deficit widened because of falling exports. First-quarter gross domestic product was revised down to a decline 0.5% from a 0.2% decline because of consumption. Durable goods spending, a proxy for private business investment, was solid. Initial jobless claims fell yet continuing claims rose again. Much of the volatility most likely stems from the rapid shifts in trade policy during May. After a weak April, marked by a pullback in spending and investment, May data showed a solid rebound—likely driven by the temporary 90-day pause in reciprocal tariffs. Still, it remains unclear whether that rebound reflects another round of front-loading ahead of potential tariff hikes or was simply a partial recovery from April’s weakness. The rise in the goods trade deficit and in durable goods orders and shipments may also be tied to higher import prices, adding further noise to the picture. That’s why we view May’s data as less indicative of underlying momentum and more reflective of temporary distortions. One data point, however, has remained consistent with our forecasts: continuing jobless claims. In an environment marked by uncertainty, businesses appear reluctant to expand, limiting opportunities for unemployed workers and new graduates. Alongside other signs of a softer labor market, this points to a gradual uptick in the unemployment rate in the months ahead. Get Joe Brusuelas’s Market Minute in your inbox every morning. Subscribe now. Looking forward, expect more volatility in June from geopolitical tensions and in July when the tariff pause expires. Should additional signs emerge that tariffs are weighing on the economy, the odds of a rate cut later this year—or as early as September—will rise sharply. But if growth continues to defy the drag from tariffs and inflation edges higher, the case for rate cuts could weaken considerably.

— news from The Real Economy Blog