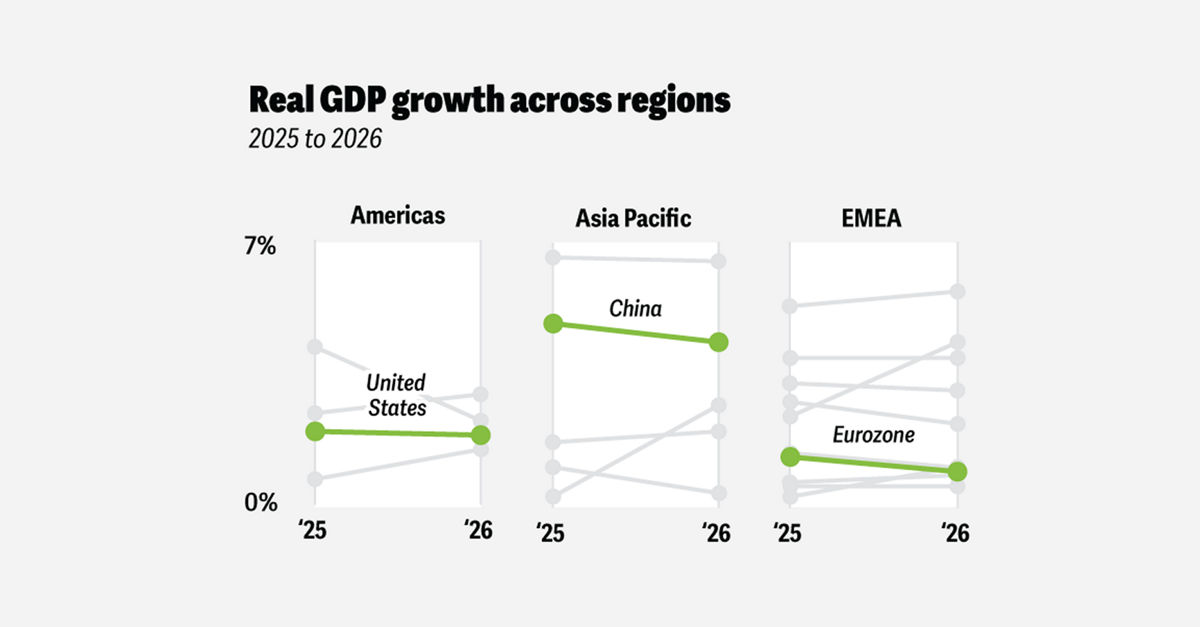

The eurozone economy has demonstrated resilience in the face of global and domestic challenges, avoiding recession despite a complex environment. Supported by a strong labor market, easing inflation, and targeted fiscal measures, the region is on track for moderate growth in 2026. However, geopolitical uncertainty and trade tensions remain key risks. n nReal GDP is projected to grow 1.4% in 2025, a slight improvement from 0.8% in 2024, driven by solid private consumption and a modest rebound in investment. Household spending benefited from a robust jobs market and improved purchasing power. Unemployment stood at 6.3% in September, close to a decade-low of 6.2%. Real incomes have recovered as wage growth remains solid—though gradually softening—while inflation has moderated. n nHeadline inflation is expected to average 2.1% in 2025, with core inflation declining due to reduced wage pressures and a stronger euro, which lowers import costs. In response, the European Central Bank (ECB) has cut its deposit facility rate four times this year by 25 basis points each, bringing it to 2% by June. This shift marks a significant move toward a less restrictive monetary stance. n nNevertheless, trade and geopolitical tensions continue to hinder growth. New U.S. tariffs on European exports—particularly autos and steel—have disrupted supply chains and weakened export momentum after an initial surge at the start of the year. While a new U.S.-EU trade agreement has mitigated some risks, the situation remains fluid. n nLooking ahead to 2026, the eurozone is expected to maintain moderate expansion, supported by sustained consumer spending. Slightly rising purchasing power, a resilient labor market, and a marginal decline in the household savings rate are expected to support economic activity. Fiscal stimulus focused on defense and infrastructure is also anticipated to boost investment, particularly in Germany. National initiatives are complemented by EU-level programs, including the “ReArm Europe/Readiness 2030” plan launched in March 2025 to finance higher defense spending, and the continued deployment of NextGen EU funds, which should provide a moderate lift to investment, especially in southern member states. n nOn the downside, export growth is likely to remain weak. Higher tariffs, a strong euro, competitiveness issues, and intense competition from China are expected to limit demand for European goods. The EU may seek to diversify export markets through new trade agreements. Initiatives under the Competitiveness Compass, if fully implemented, could enhance long-term resilience, but their impact will take time to materialize. n nOverall, eurozone GDP is projected to grow 1.1% in 2026. While slightly lower than 2025’s figure, underlying growth dynamics are expected to strengthen modestly. These forecasts come with high uncertainty, particularly regarding U.S. trade policy, the Russia-Ukraine conflict, and potential financial market corrections linked to AI investments. n— news from Deloitte

— News Original —

Global economic outlook 2026

Eurozone n n– Pauliina Sandqvist n nThe eurozone economy has shown resilience amid a complex mix of global and domestic challenges this year. While its post-pandemic recovery was disturbed by multiple challenges, the region has avoided recession, supported by a robust labor market, easing inflation, and selective fiscal measures. In 2026, moderate growth will hinge on domestic demand and national as well as EU-level investment initiatives, but geopolitical uncertainty and trade tensions pose key risks. n nReal economic growth in the eurozone is projected to reach 1.4%38 in 2025, a modest improvement over 2024 (0.8%), driven by robust private consumption and a slight rebound in investment. Private consumption benefited from labor market strength and improved purchasing power. The labor market has been a key stabilizer, with unemployment standing at 6.3%39 in September, very close to its lowest level (6.2%) in over a decade. Real incomes have recovered further as wage growth remains buoyant—even if it is softening slowly—and inflation levels have moderated. n nOverall, headline inflation is likely to average 2.1%40 in 2025, with core inflation easing due to declining wage pressures and a stronger euro, which makes imports into the euro area more affordable. In line with these inflation developments, the European Central Bank announced a 25-basis-point rate cut four times this year, bringing its deposit facility rate to 2% in June. Thus, the monetary policy stance has become significantly less restrictive. n nHowever, geopolitical and trade tensions continue to weigh on growth. The imposition of new US tariffs on European exports—particularly autos and steel—has disrupted supply chains and dampened export growth, after positive front-loading effects at the beginning of the year. Although a new US-EU trade agreement has reduced some risks, the situation remains unclear and is evolving. n nLooking ahead to 2026, the eurozone economy is expected to keep expanding moderately, supported by various factors. First, sustained consumer spending growth, driven by slightly expanding purchasing power, a still-robust labor market, and a minor decline in the household savings rate, is likely to contribute positively to economic activity. n nSecond, fiscal stimulus related to defense and infrastructure is also expected to boost investment activity in countries like Germany. In addition to national actions, there are also multiple EU-level actions contributing to this. The “ReArm Europe/Readiness 2030” plan, introduced in March 2025, outlines a broad strategy to finance increased defense expenditures.41 The NextGen EU funds are also expected to provide a moderate boost to investment growth in 2026, particularly in southern eurozone economies.42 n nOn the other hand, export growth is likely to be weak next year: Besides higher tariffs and a strong exchange rate, competitiveness-related challenges and strong competition from China will drag on demand for European exports. The European Union will likely try to diversify its export markets through further trade agreements. The push behind initiatives under the Competitiveness Compass, if undertaken as planned, should make Europe more economically resilient and future-proof. However, both of these actions will take time, and it is unclear how significant their positive effects will be. n nOverall, the eurozone economy is projected to grow by 1.1% next year.43 Even though the annual figure is slightly lower than in 2025, underlying growth dynamics are expected to strengthen slightly. n nThese forecasts are surrounded by relatively high uncertainty, especially regarding US trade policy, the Russia-Ukraine war, and possible financial-market corrections driven by AI investments.