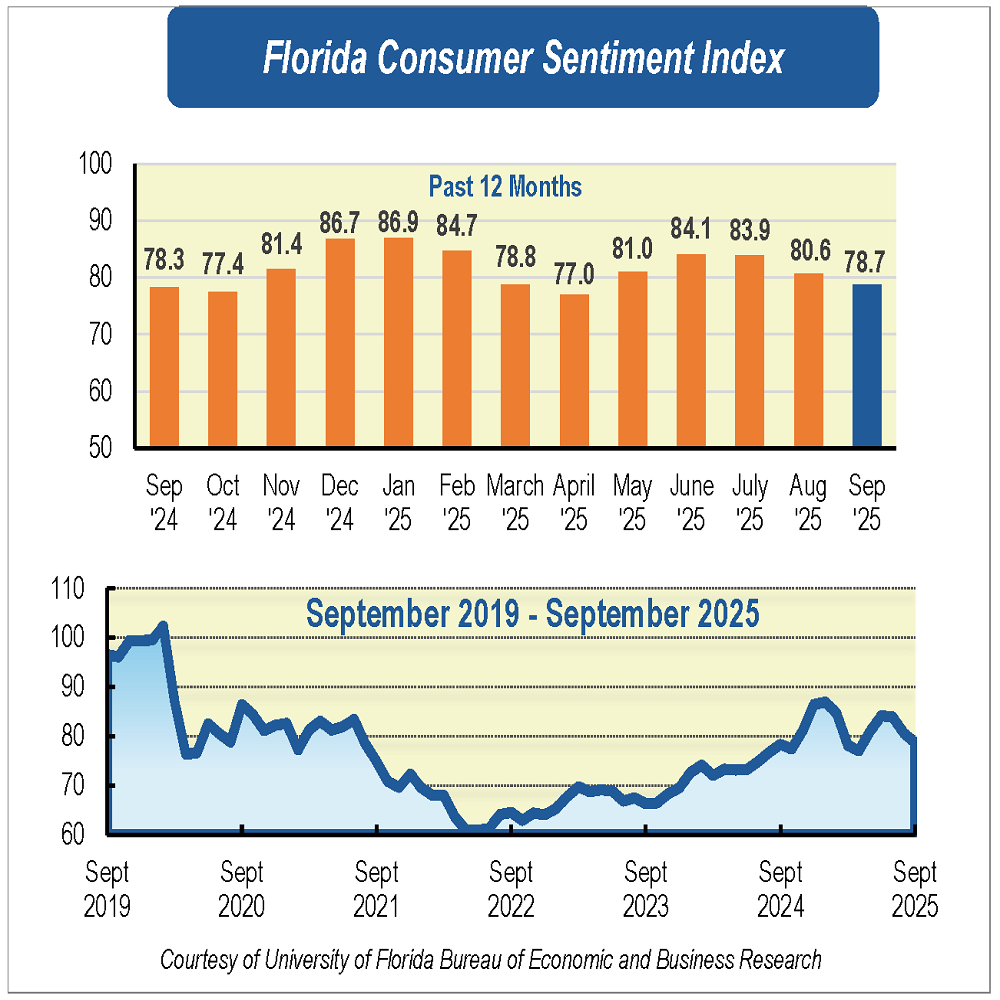

In September, consumer sentiment in Florida decreased for the third straight month, dropping 1.5 points to 78.7 from a revised 80.2 in August. The national index also fell, registering a decline of 3.1 points. According to Hector H. Sandoval, director of the Economic Analysis Program at the University of Florida’s Bureau of Economic and Business Research, the drop stems largely from weaker spending plans and rising anxiety about the broader economy. While the most pronounced fall was in Floridians’ readiness to make large purchases, long-term projections for the U.S. economy also dipped to their weakest level in 18 months. This echoes earlier periods of high inflation, though today’s concerns are compounded by signs of softening in the labor market—factors that have led the Federal Reserve to implement its first interest rate reduction since December.

Of the five indicators that constitute the sentiment index, four declined and one held steady. Perceptions of current economic conditions worsened across the state. Views on personal financial situations compared to a year ago slipped slightly from 71.7 to 71.3. Meanwhile, the belief that it’s a favorable moment to buy major household items—such as appliances or furniture—plummeted by 4.4 points, from 74.9 to 70.5, marking the largest monthly drop among all components. These trends were consistent across most demographic groups, with the exception of women, who expressed slightly improved outlooks on their financial standing.

Future expectations also weakened, particularly regarding the national economic climate. Projections for personal finances one year ahead remained flat at 87, although men, individuals under 60, and those earning over $50,000 annually reported more pessimistic views. Expectations for the U.S. economy in the coming year declined from 84.2 to 83, while five-year forecasts dropped from 83.3 to 81.7. However, demographic differences emerged: women and lower-income individuals (under $50,000) expressed relatively more optimism about the national economy.

Additional economic developments include the expansion of tariff policies, with new duties imposed on Indian goods early in September and later on pharmaceuticals, trucks, and kitchen cabinets. These actions face legal scrutiny, as a federal appeals court has questioned their validity, though they remain active pending a Supreme Court decision. Revised labor statistics also revealed fewer jobs created over the past year than previously reported. Despite volatility in weekly jobless claims, both Florida’s and the national unemployment rates rose only marginally.

Sandoval noted that while current sentiment remains significantly higher than the lows seen in 2022—when persistent inflation heavily impacted residents—the outlook is now clouded by a slowing labor market, inflation above the target rate, and uncertainty surrounding trade policies and future Federal Reserve actions. These pressures could continue to dampen consumer confidence in the near term.

The University of Florida’s survey, conducted from August 1 to September 25, gathered responses from 546 individuals via cellphone and 263 through an online panel, totaling 809 participants representative of Florida’s population. Data were weighted by county of residence, age group, and gender using official population estimates from the Bureau of Economic and Business Research. Quality control measures included monitoring interviews for duplicates (phone) and deploying fraud detection, filtering incomplete responses, and blocking search engine indexing (online).

The index is benchmarked to 1966, where a score of 100 reflects the confidence level of that year. The theoretical range spans from a minimum of 2 to a maximum of 150.

— news from University of Florida

— News Original —

National, Florida consumer confidence weakens amid economic uncertainty

Consumer sentiment in Florida declined for the third consecutive month in September, falling 1.5 points to 78.7 from a revised figure of 80.2 in August. Similarly, national sentiment declined 3.1 points. n n“This month’s decline is driven primarily by reduced spending intentions and growing concerns about the national economy. While the steepest drop was in Floridians’ willingness to purchase big-ticket items, long-term expectations for the U.S. economy also fell, reaching their lowest level in 18 months. At that time, concerns focused on unexpectedly high inflation. Today, similar worries may be resurfacing, but they are now accompanied by signs of labor market weakness. This shift has prompted the Fed to respond with its first rate cut since December,” said Hector H. Sandoval, director of the Economic Analysis Program at University of Florida’s Bureau of Economic and Business Research. n nAmong the five components that make up the index, four declined and one remained unchanged. n nFloridians’ views on current economic conditions turned more pessimistic in September. Opinions of personal financial situations compared with a year ago fell slightly 0.4 points from 71.7 to 71.3. Opinions on whether now is a good time to buy a major household item, such as an appliance or furniture, dropped sharply 4.4 points from 74.9 to 70.5, the largest decline among all components this month. These downward shifts were broadly shared across sociodemographic groups, except for women, who reported more favorable views on their personal financial situation. n nLikewise, expectations about future economic conditions declined, especially regarding the national outlook. Expectations of personal financial situations a year from now remained unchanged at 87, though men, people younger than 60 and people with an annual income over $50,000 reported more negative views. Outlooks of U.S. economic conditions over the next year fell 1.2 points from 84.2 to 83, and expectations of U.S. economy conditions over the next five years declined 1.6 points from 83.3 to 81.7. However, views on the national economy were split across demographic groups, with women and people with an annual income under $50,000 reporting more optimistic expectations. n nIn other economic developments, the administration expanded its tariff campaign, introducing new levies on Indian goods in early September and on pharmaceuticals, trucks and kitchen cabinets later in the month, even as a federal appeals court questioned the legality of these trade measures, which remain in place pending Supreme Court review. Meanwhile, revised labor market data showed significantly fewer jobs over the past year. Although weekly jobless claims have seen sharp swings, both Florida’s and the national unemployment rates ticked up only slightly. n n“Consumer sentiment remains well above the lowest levels observed in 2022, when persistent inflation weighed heavily on Floridians. Still, the current outlook is shaped by a cooling labor market, inflation that remains above target and ongoing policy uncertainty related to tariffs and the Fed’s next moves. Looking ahead, these factors may continue to weigh on sentiment, and we could see further declines in the months to come,” Sandoval said. n nConducted Aug. 1 to Sept. 25, the UF study reflects the responses of 546 individuals who were reached on cellphones and 263 individuals reached through an online panel, a total of 809 individuals, representing a demographic cross section of Florida. n nData are weighted based on Florida county of residence, age group, and sex to ensure representativeness of the Florida population. The population figures used for weighting (targets) are obtained from the Population Program of the Bureau of Economic and Business Research (BEBR), which produces the official population estimates for the state of Florida. Phone data quality is maintained by monitoring and reviewing interviews and prevention of duplicate records. Online data quality is maintained by enabling and reviewing bot and fraud detection, elimination of “short time” completes and preventing the survey from appearing in web search results. n nThe index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is 2, and the highest is 150.