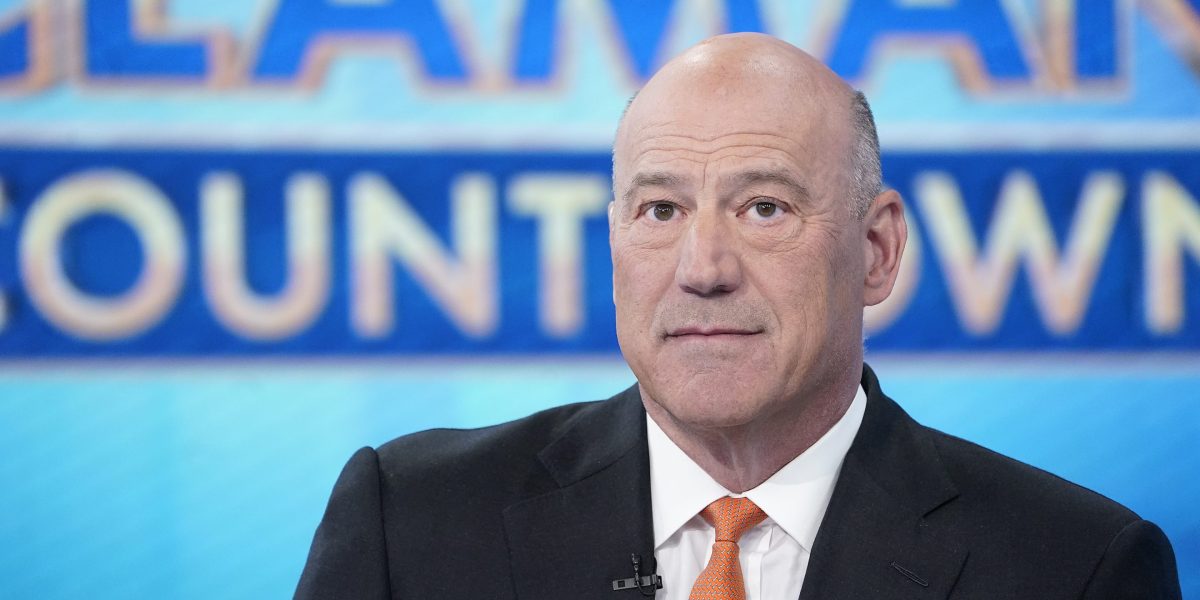

Gary Cohn, who led the National Economic Council during the initial Trump administration, argued that tariffs are contributing to a weakening job market by increasing input costs for businesses. In an interview on “Face the Nation,” Cohn explained that companies, unable to pass these higher expenses fully onto consumers, are instead reducing labor expenditures to preserve profit margins.

“The one lever they can pull to make sure they keep their margins intact is they can cut down on the cost of labor,” Cohn stated, highlighting how operational constraints are shaping corporate hiring and staffing decisions.

Despite this, White House spokesperson Kush Desai countered that President Trump’s tariff policies have spurred trillions of dollars in domestic investment and job creation for American workers. According to Desai, the administration continues prioritizing supply-side economic strategies such as tax reductions, reduced regulatory burdens, and expanded energy production to lower business costs and revive the growth seen during Trump’s earlier term.

Major technology firms including Google, Microsoft, and Meta have intensified workforce reductions this year. Data from Layoffs.fyi shows nearly 90,000 tech employees have been let go across 204 companies in 2025 alone. Cohn, currently serving as vice chairman at IBM, warned these cuts are already influencing broader economic conditions.

Recent figures from the Bureau of Labor Statistics indicate only 22,000 jobs were added in August, a sharp decline from 79,000 in July. In response, the Federal Reserve reduced interest rates by 0.25 percentage points last week in an effort to stimulate economic activity. While Fed Chair Jerome Powell emphasized that overall layoffs remain low, he acknowledged challenges in employment access—particularly for younger workers and marginalized groups. Powell noted that recent graduates and minorities are facing increased difficulty securing positions. One young job seeker, aged 25, reportedly walked Wall Street with a sign advertising his availability after submitting over 1,000 online applications.

Cohn described a shift from the pandemic-era labor market, when companies aggressively retained staff due to hiring fears, to today’s environment where firms are tightly managing expenses.

“We came out of a tough situation in COVID where companies were actually afraid about being able to attract and retain people, so they were hoarding labor,” Cohn said. “So we went from a hoarding labor situation to a situation today where companies are being very aggressive about managing their expenses, and the one expense they can manage is the cost of labor.”

Even as corporate revenues rose 6.3% in the second quarter and profits surged by double digits, signs point to a softening employment landscape. Members of the Federal Open Market Committee have indicated at least two additional rate cuts may be considered this year, potentially supporting the employment component of the Fed’s dual mandate.

“It may be temporary, it may be quite temporary, but the reality is, we have seen the job market degrade,” Cohn concluded.

— news from Fortune

— News Original —

Former Trump economic adviser Gary Cohn says tariffs are why you aren’t landing a job

Gary Cohn, who served as director of the National Economic Council during the first Trump administration, said businesses are feeling the insecurity of rising input costs thanks to tariffs. And because companies feel they can’t raise prices for consumers, they turn to what they can control. n n“The one lever they can pull to make sure they keep their margins intact is they can cut down on the cost of labor,” Cohn said in an interview on Face the Nation. n nWhite House spokesman Kush Desai said in a statement to Fortune that President Trump’s tariffs have led to trillions of dollars of investment for building in the U.S. and hiring Americans. n n“The Administration remains focused on implementing a full suite of supply-side growth policies like tax cuts, deregulation, and energy abundance to reduce cost and restore the economic dynamism that Americans experienced during President Trump’s first term.” n nSome of the biggest tech companies in the world have ramped up layoffs this year including Google, Microsoft, and Meta. Overall, just under 90,000 tech workers have been laid off this year alone at 204 companies, according to Layoffs.fyi. n nCohn, now the vice chairman of IBM, said these job cuts have already started to affect the economy. Recent jobs data from the Bureau of Labor Statistics revealed only 22,000 jobs were added in August, down from 79,000 in July. Last week, the Federal Reserve lowered interest rates by a quarter of a percentage point to try to stem the tide and bolster the economy. n nTo be sure, Fed chairman Jerome Powell said in a press conference following the Fed meeting last week that the layoff rate is still low overall. Yet, finding a job is getting harder, especially for Gen Z recent graduates, because companies are putting the brakes on hiring. Following last week’s Fed meeting, Powell acknowledged, “kids coming out of college and younger people, minorities, are having a hard time finding jobs.” One 25-year-old even walked around Wall Street with a poster lobbying for an entry-level position after having applied to more than 1,000 jobs online. n nThis trend marks a reversal from the COVID years when many companies went on a hiring frenzy, said Cohn. Now, these same companies are also letting their labor force decline naturally as workers retire. n n“We came out of a tough situation in COVID where companies were actually afraid about being able to attract and retain people, so they were hoarding labor,” Cohn said. “So we went from a hoarding labor situation to a situation today where companies are being very aggressive about managing their expenses, and the one expense they can manage is the cost of labor.” n nWhile Americans struggle with longer job searches, companies are doing just fine, Cohn added. Corporate revenues rose 6.3% in the second quarter while profits jumped double digits, but hard numbers and anecdotal data point to a degrading job market. Members of the Federal Open Market Committee have signaled at least two more rate cuts could be on the table for the year, which could help tackle the employment side of the Fed’s dual mandate. n n“It may be temporary, it may be quite temporary, but the reality is, we have seen the job market degrade,” said Cohn.