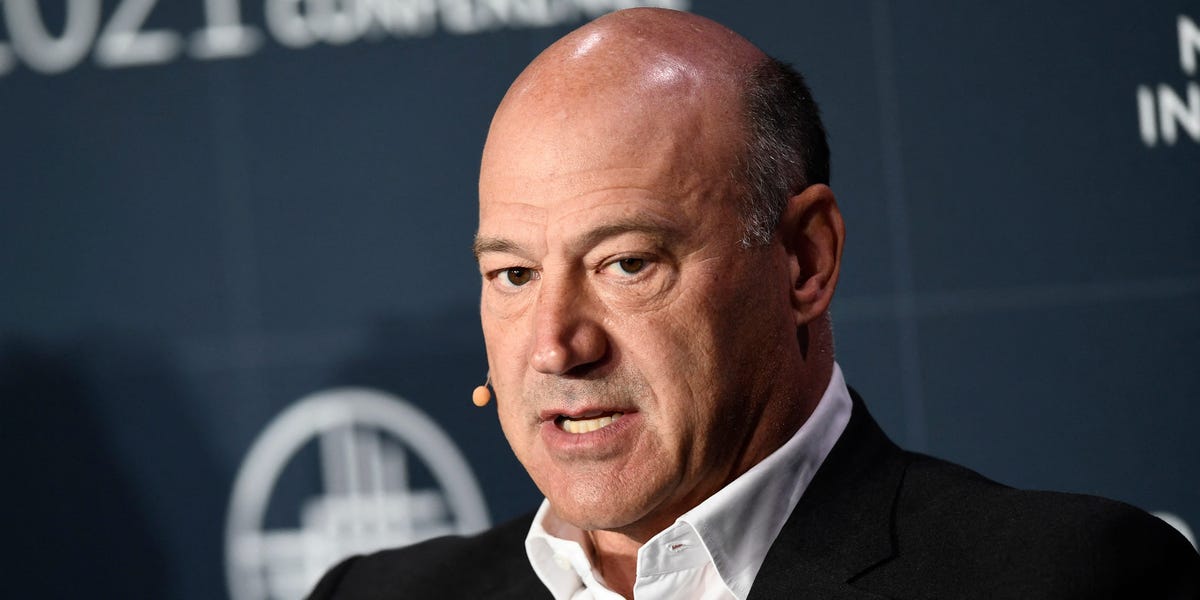

Former Trump administration economic advisor Gary Cohn has highlighted a growing divide in the American economy, noting that while macroeconomic indicators like GDP are showing robust performance, many working families continue to face financial hardship. Speaking on CBS’s “Face the Nation,” Cohn pointed out that the nation’s gross domestic product is currently expanding at a rate of around 5%, a figure that reflects strong overall economic output.

Cohn, who now serves as vice chairman at IBM, also acknowledged improvements in inflation and joblessness metrics. Yet he emphasized that these aggregate statistics mask significant disparities beneath the surface. He described the current economic landscape as one where individuals at the upper end of the wealth spectrum are benefiting substantially, while ordinary workers are finding it increasingly difficult to cover essential expenses.

“There’s a massive wealth effect at the top,” Cohn observed, “but at the same time, hardworking Americans are struggling to make ends meet.” He added that this imbalance has prompted the White House to prioritize affordability in its upcoming policy agenda, with President Trump expected to focus public messaging on cost-of-living challenges in the lead-up to the midterm elections.

This divergence in economic experience is commonly referred to as a K-shaped recovery, where different segments of the population move in opposite directions following an economic shock. Economists such as Gregory Daco of EY have warned that prolonged affordability pressures and rising borrowing costs are forcing middle- and lower-income households to dip into savings and rely more on credit to maintain their standard of living.

Joe Brusuelas, chief economist at RSM, noted that existing policy frameworks appear to favor the upper tier of the K, suggesting that inequality may deepen in the years ahead unless structural reforms are implemented. However, he expressed skepticism that meaningful shifts would occur by 2026.

— news from Business Insider

— News Original —

Trump’s former chief economic advisor says workers are ‘suffering’ in America’s K-shaped economy

President Donald Trump has boasted about strengthening the US economy since returning to the Oval Office. Meanwhile, millions of Americans say they ‘re struggling to afford food, rent, and other basic necessities. n nGary Cohn, Trump ‘s former chief economic advisor, said both these realities are true right now in America. n n”If you look at gross domestic product, which is the overall output of the US economy, we ‘re trending about 5% right now, which is a very high growth rate in the United States,” Cohn said on CBS ‘ “Face the Nation” on Sunday. n nCohn, who is now IBM ‘s vice chairman, also cited promising trends in inflation and unemployment rates. n nHowever, those numbers don ‘t give the whole picture. n n”That said, we ‘ve got an interesting economy,” Cohn said. “We have a massive wealth effect at the top end, and we have got hardworking Americans having a very difficult time paying their bills, and they are suffering in this economy.” n nThat ‘s why, Cohn said, the Trump administration is making affordability a key issue going forward. n n”The White House is going on the offensive. The president is going to spend time out on the road talking about affordability,” Cohn said. “Affordability will be the issue between now and the mid-term elections.” n nThe widening gap between wealthy and lower-income Americans is often described as a “K-shaped economy.” That ‘s when people at the top see profound economic growth, while those at the bottom, who are more sensitive to economic shifts, face financial stress. Some economists have cautioned that a K-shaped economy portends bad days ahead. n n”A silent majority of consumers is increasingly strained by a two-year affordability crisis and elevated borrowing costs,” Gregory Daco, a chief economist at EY, said in a recent LinkedIn post. “Slower income growth is pushing many upper-median, median, and lower-income families to draw down savings and rely more heavily on credit to sustain their habits.” n nThe chief economist of RSM, Joe Brusuelas, said in a recent briefing that the US would need to undergo policy shifts to reshape the economy, but that likely won ‘t happen in 2026. n n”When I take a look at the policy landscape, it ‘s all tilted toward the upper spur of the K,” he said. “So I ‘m expecting a further widening of that fundamental inequality in coming years.”