Canada’s financial system, defined by the balance between banking institutions and capital markets, plays a crucial role in supporting long-term economic stability and growth. A recent study investigates how natural resource wealth, digital innovation, and economic policy uncertainty influence the evolution of this financial architecture. Using advanced statistical techniques—wavelet quantile regression (WQR) and quantile-on-quantile regression (QQR)—the research analyzes quarterly data from 1990 to 2022 to uncover nonlinear and time-varying relationships.

Natural resource endowments, including oil, gas, minerals, and timber, have long been central to Canada’s economy. While some theories suggest such wealth leads to economic stagnation—the so-called “resource curse”—the findings indicate a different outcome: a positive long-term association between resource revenues and financial structure, supporting the “resource blessing” hypothesis. This effect becomes more pronounced over extended periods, particularly when institutional frameworks are strong and revenue is reinvested into financial infrastructure.

Digitization emerges as a key amplifier of this relationship. In the short term, technological transformation may create adjustment challenges for traditional financial sectors. However, beyond the 40th percentile of financial development, digital advancements significantly enhance access, efficiency, and resilience. Growth in fintech, mobile banking, blockchain applications, and AI-driven financial services contributes to deeper market integration and improved capital allocation.

Economic policy uncertainty (EPU), often viewed as a deterrent to investment, shows a nuanced impact. At lower levels of financial development, moderate uncertainty correlates with slightly positive outcomes, possibly encouraging precautionary savings and regulatory strengthening. At higher levels, well-established financial institutions demonstrate adaptive capacity, turning volatility into opportunities for innovation and diversification.

Regulatory quality and inflation are also critical factors. Strong governance enhances investor confidence and ensures transparent management of resource revenues, with greater effects visible in mature financial environments. In contrast, high inflation negatively affects weaker financial systems by eroding real returns and increasing borrowing costs, though its impact diminishes under stable monetary conditions—consistent with Canada’s inflation-targeting framework of 2–3%.

The study further reveals that while natural resources initially exert negative pressures in the short to medium term—likely due to volatility or inefficient governance—their long-term influence turns decisively positive. This shift underscores the importance of strategic planning, institutional maturity, and sustained investment in transforming resource income into structural financial gains.

By applying WQR, the research disentangles effects across time horizons: short-term (1–2 years), medium-term (3–5 years), and long-term (6+ years). The results show that benefits from resource wealth accumulate gradually, reinforcing the idea that durable financial development depends on patience, policy consistency, and technological readiness.

These insights offer valuable guidance for policymakers aiming to balance resource dependence with financial modernization. They highlight the need to strengthen regulatory frameworks, invest in digital infrastructure, and manage macroeconomic stability to ensure that natural wealth translates into lasting financial resilience.

— news from Springer Nature

— News Original —

Investigating the nonlinear nexus between natural resources, digitization, economic policy uncertainty, and financial structure in Canada

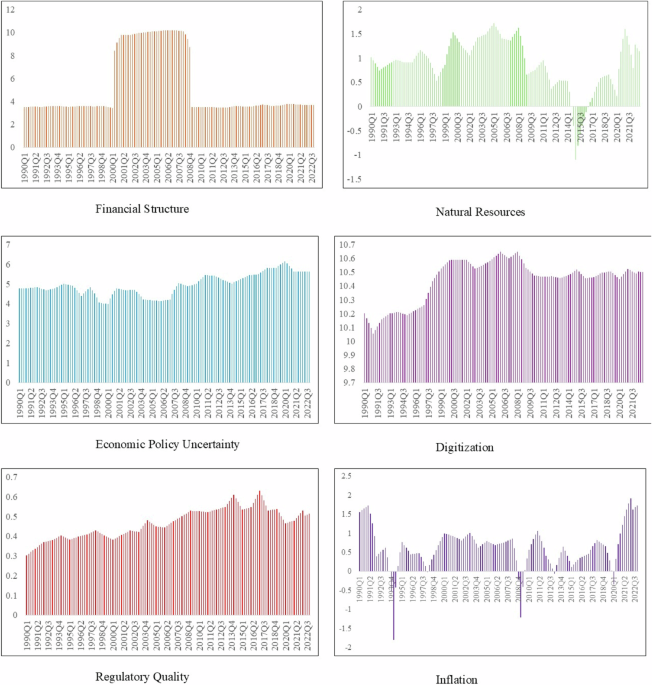

The stability and composition of a country’s financial system—broadly referred to as its financial structure (FinS)—play a pivotal role in sustaining long-term economic growth, allocating capital efficiently, and absorbing macroeconomic shocks (Hussain et al., 2023; Iqbal et al., 2022). In resource-rich nations like Canada, understanding how natural resource endowments affect FinS remains a contested topic, often framed through the opposing lenses of the “resource curse” and the “resource blessing” hypotheses (Sun et al., 2024; Ullah et al., 2023a, 2023b). While prior research has predominantly focused on financial development in emerging markets, fewer studies have rigorously examined how natural resources (NRs) shape FinS in advanced economies, especially under the influence of evolving technological and policy dynamics (Ali et al., 2023; Appiah-Otoo et al., 2023). n nTheoretically, FinS differs from financial development in that it captures the relative importance and interaction between banking systems and capital markets, rather than just measuring access, depth, and efficiency (Iqbal et al., 2023a; Valentine et al., 2024). For instance, a shift toward a market-based structure may facilitate risk-sharing and innovation, whereas a bank-dominated structure may provide stability during uncertainty (Hou et al., 2023; Li et al., 2024). Despite this distinction, existing empirical research often uses the terms interchangeably, leading to conceptual ambiguity (Iqbal et al., 2023b; Teng, 2023). This study addresses this gap by clearly operationalizing FinS as an index encompassing financial depth, access, efficiency, and stability, with a specific focus on how its evolution is conditioned by external drivers (Amin et al., 2023; Luo, 2024). n nOne such driver is digitization, which is widely regarded as a catalyst for financial transformation (Tao et al., 2024). Theoretically, digitization improves transaction speed, reduces information asymmetries, and enhances access to financial services (Ullah et al., 2023a, 2023b). These digital advancements can also mediate the resource–finance nexus by improving institutional efficiency and reducing reliance on traditional revenue streams. Similarly, economic policy uncertainty (EPU) affects investor confidence and the cost of capital, making it a critical variable in financial system responsiveness (Ahmed et al., 2025). Under high uncertainty, capital markets may retrench while banks adopt conservative lending strategies, which in turn affect FinS (Mengfeng et al., 2024). Regulatory quality (RQ) and inflation (INF) are also relevant, as weak governance or high price volatility can distort credit allocation and undermine financial market credibility. n nDespite these theoretical pathways, limited empirical evidence exists on how digitization and EPU influence the natural resource–FinS relationship. Most existing studies focus on direct effects, without exploring how these external factors shape the interaction. Moreover, the use of advanced nonlinear techniques like WQR and QQR remains rare in this context, particularly in high-income economies. n nCanada offers a compelling case for study. It is one of the world’s most resource-rich countries, with vast reserves of oil, gas, minerals, timber, and freshwater (Baruah and Biskupski-Mujanovic, 2023). Its natural resource wealth contributes significantly to GDP, trade balance, and fiscal revenues. In addition, Canada is a leading financial center, particularly in resource financing, with institutions that are globally competitive and innovation-driven (Canada, 2023). However, it also faces policy uncertainty related to environmental regulation, indigenous rights, and carbon pricing—factors that can complicate the resource–finance relationship. These structural and institutional characteristics distinguish Canada from previously studied cases and make it an ideal context to test theoretical assumptions. This study aims to answer two central research questions: (i) does Canada exhibit characteristics of resource blessing or resource curse in terms of FinS?; (ii) how do digitization and EPU shape the consequences of NRs on Canada’s FinS? n nTo answer these questions, we employ WQR and QQR, which allow us to capture both temporal and distributional heterogeneity. These methods are particularly suited to modeling nonlinear, time-varying relationships that may otherwise be obscured in traditional regression techniques. Our results reveal a positive long-term association between natural resource wealth and FinS, suggesting a resource blessing effect. Additionally, digitization and EPU act as reinforcing factors, enhancing financial stability and adaptability across quantiles. These insights offer both theoretical and policy contributions by redefining how external macro and institutional factors modulate the resource-finance nexus in advanced economies. n nThe rest of the paper is structured as follows: section “Theoretical Linkages and Literature Review” reviews the related literature. Section “Methods” discusses the data and methodology. Section “Empirical Results” presents empirical results, while section “Conclusion and Policy Implications” outlines conclusions and policy implications. n nA robust FinS is fundamental to a country’s economic development, facilitating efficient capital allocation, risk management, and financial intermediation (Bekun et al., 2024; Yadav et al., 2024). The effectiveness of this structure, however, is often shaped by both endogenous factors (such as natural resource endowments) and exogenous influences (like digitization, policy uncertainty, and macroeconomic stability). In this context, RQ and INF are crucial control variables. High RQ ensures effective contract enforcement, transparency, and investor protection—key elements that determine how resource-based revenues are absorbed into the financial system. It also enhances institutional capacity to channel natural resource rents into long-term productive investments (Bekun et al., 2025). Similarly, INF affects the real value of financial assets and borrowing costs, influencing both the depth and resilience of financial systems. In high-INF scenarios, capital may flee toward INF-hedged instruments or foreign markets, weakening FinS. Conversely, price stability reinforces public trust in domestic financial systems, encouraging capital retention and long-term financial planning. n nEmpirical studies have produced mixed findings across contexts. Zhang and Liang (2023) used bootstrap quantile regression to investigate South Asian economies, reporting a consistent negative influence of NRs on financial development, thereby confirming the resource curse. Conversely, Atil et al. (2020) found that natural resource wealth had a positive long-run effect on Pakistan’s financial system, although short-run effects were insignificant. Similarly, Yıldırım et al. (2020) and Tang et al. (2022) offered contrasting evidence of NRs enhancing financial development in association of southeast Asian nations (ASEAN) and developing economies, challenging the paradoxical view. However, these studies largely focus on financial development rather than FinS and rarely account for complex, nonlinear interdependencies over time and distributional dimensions. n nNotably, the concept of FinS—which reflects the composition and relative dominance of banking versus capital markets—is distinct from financial development, which focuses on depth, access, and efficiency. This distinction is critical in high-income economies like Canada, where capital markets play a more prominent role. Few studies to date have explored how resource dynamics affect FinS specifically, especially in countries with mature institutional frameworks. For instance, in OECD economies, resource revenues are more likely to be funneled through formal financial markets and regulated investment vehicles, potentially altering the transmission mechanism compared to resource-rich developing nations. However, empirical work in this domain remains limited, and existing models applied to countries like Canada are sparse. n nThe Canadian case is particularly suitable given its dual characteristics of resource richness and sophisticated financial infrastructure. Canada ranks among the top global producers of oil, natural gas, minerals, and forest products, while also hosting one of the world’s most developed equity markets. This unique combination enables an investigation of how institutional quality and innovation moderate the NR–FinS relationship in a high-capacity governance setting—an angle not fully explored in the literature. Relevant OECD-centered studies (Appiah et al., 2024; Nguyen et al., 2025; Zhang et al., 2025) have identified similar mechanisms, where resource wealth enhances financial markets only under strong institutional and innovation frameworks, but Canada-specific empirical evidence remains scarce. n nBeyond resources, digitization has emerged as a transformative force for financial architecture. Technological innovation enhances financial access, increases transparency, and reduces transaction costs—key dimensions in strengthening both financial depth and structure. Zhou and Du (2021) find that technology supports financial expansion in China, while Abbasi et al. (2022) show that innovation plays a significant role in financial development in high-income countries. However, most studies treat digitization as a direct driver of financial progress; few explore its role as a moderating factor in resource-rich contexts. n nThis study addresses this omission by proposing that digitization amplifies the positive effects of NRs on FinS by improving resource efficiency, increasing transparency, and enabling better capital allocation. In developed economies, digitization also interacts with regulatory frameworks and market sophistication to reduce volatility and mitigate rent-seeking behaviors that often accompany resource windfalls. n nSimilarly, EPU introduces risk into investment decisions, which can dampen or redirect capital flows. While high EPU can discourage private sector lending and investment, it can also drive precautionary shifts toward stable, institutionalized financial channels. In Canada, a relatively stable policy environment may mitigate these adverse effects, allowing EPU to function as a risk signal that reconfigures the allocation of resource-based revenues. These dual potentials underline the need to examine nonlinear effects across varying conditions (Yadav, 2025; Yadav and Behera, 2023). n nFrom a methodological perspective, prior studies have employed a broad set of estimation techniques, such as autoregressive distributed lag, FMOLS, and quantile regression. However, few have utilized WQR to analyze both frequency-specific and distributional variation in financial outcomes. The present study builds upon the framework of Kumar and Padakandla (2022) and innovates by extending WQR and QQR to examine the conditional influence of NRs, EPU, and digitization on FinS within Canada, a developed economy context largely missing from current discourse. n nData n nThis study evaluates the influence of NRs, EPU, and technological innovation (TNI) on Canada’s FinS, while accounting for RQ and INF as control variables. The dataset spans from the first quarter of 1990 to the fourth quarter of 2022, utilizing quarterly observations specific to Canada. n nFinS serves as the dependent variable and is constructed from four core components: (i) financial depth, which reflects the size of financial markets and institutions; (ii) financial access, capturing the availability and usage of financial services by individuals and businesses; (iii) financial efficiency, which assesses how effectively financial systems facilitate transactions and allocate capital; and (iv) financial stability, indicating the resilience of financial institutions and markets to shocks. These components are sourced from the World Bank’s Global Financial Development Database (World Bank, 2022), which compiles comprehensive financial statistics across more than 200 countries and over six decades. The index integrates indicators related to banking systems, insurance sectors, and capital markets, including both stock and bond markets, thereby offering a well-rounded representation of a country’s financial architecture. n nRQ is drawn from the Worldwide Governance Indicators and captures the ability of public institutions to formulate and enforce sound policies and regulations that encourage private sector participation. In the context of resource-driven economies, strong RQ is essential for effective financial oversight, investor protection, and the sustainable management of resource revenues. INF is measured as the year-over-year percentage change in the consumer price index, obtained from World Bank data. INF directly impacts financial system performance by influencing interest rates, investment decisions, and credit conditions. Persistent INF can erode trust in financial assets, while stable INF enhances predictability and supports long-term financial planning. n nTable 1 provides comprehensive data on the parameters used. n nAll variables are transformed into natural logarithms to normalize their distributions and mitigate the effects of heteroscedasticity (Özcan et al., 2024). The Canadian context provides a compelling case study given the country’s extensive natural resource base, sophisticated financial infrastructure, and evolving institutional and policy landscape. In addition, the annual data is converted into quarterly data to convert low-frequency data into high-frequency data, as shown in the research conducted by Jahanger et al. (2024), Kartal et al. (2024a), and Liu et al. (2024). Moreover, Fig. 1 displays the log-transformed patterns of the chosen variables in a graphical format. n nMethodology n nQuantile regression (QR) is widely used to examine how explanatory variables influence the conditional distribution of a response variable across various quantiles. This approach is formulated as: n n$${ phi }_{(q)}(Y|X)={ beta }_{0({ rm{q}})}+{ beta }_{1({ rm{q}})}X$$ n n(1) n nIn this context, the expression ({ phi }_{(q)}(Y|X) ) denotes the q-th quantile of the dependent variable Y, given the value of the independent variable X. The term ({ beta }_{0({ rm{q}})} ) associated with the intercept captures the baseline effect at quantile q, while the coefficient ({ beta }_{1({ rm{q}})} ) reflects how changes in X influence Y at that specific quantile. n nHowever, conventional QR fails to capture dynamic behavior across time scales, especially in macro-financial datasets where short-, medium-, and long-term effects may differ. To address this limitation, we employ the WQR approach proposed by Kumar and Padakandla (2022). This method is particularly well-suited for our research objective, which involves detecting time- and quantile-varying relationships between NRs, policy uncertainty, digitization, and FinS in Canada. n nThe WQR framework integrates Maximal Overlap Discrete Wavelet Transform (MODWT), as introduced by Percival and Walden (2000), to decompose each time series into multiple frequency components. This enables a richer understanding of how relationships evolve across different time horizons. Unlike traditional wavelet methods, MODWT maintains temporal alignment and handles non-dyadic data more flexibly—ideal for economic time series of quarterly frequency. n nThe time series X[i] is assumed to have a length T, where T = 2 J and J shows a whole number. In the wavelet decomposition process, the filter ℎ1[i] acting as a smoothing filter, while g1[i] acts as a high-pass filter, capturing the detail structure of the data. During the initial step, the signal X[i] is passed through ℎ1[i], generating general trend values α1[i] over a defined interval N. A similar convolution using g1[i] produces the detail coefficients, also labeled α1[i], corresponding to the same interval. This filtering procedure enables the separation of low- and high-frequency components of the signal for further analysis. n n$${ alpha }_{1}[i]={h}_{1}[i] ast s[i]= mathop{ sum} limits _{k}{h}_{1}[i-k]s[k]$$ n n(2) n n$${d}_{1}[i]={g}_{1}[i] ast s[i]= mathop{ sum} limits _{k}{g}_{1}[i-k]s[k]$$ n n(3) n nIn the following stage, the approximation coefficients α1[i] are further processed using revised filters ℎ2[i] and g2[i], which are generated through upsampling the initial filters ℎ1[i] and g1[i]. This procedure incorporates both recursive and stepwise operations. To maintain precision in the decomposition, we consider multiple resolution levels, ranging from 1 up to J0 − 1, where J0 is less than or equal to the maximum level J. n n$${ alpha }_{j+1}[i]={h}_{j+1}[i] ast { alpha }_{j}[i]= mathop{ sum} limits _{k}{h}_{j+1}[i-k]{ alpha }_{j}[{ rm{i}}]$$ n n(4) n n$${d}_{j+1}[i]={g}_{j+1}[i] ast { alpha }_{j}[i]= mathop{ sum} limits _{k}{g}_{j+1}[{ rm{n}}-k]{ alpha }_{j}[{ rm{j}}]$$ n n(5) n nHere, the transition from gj[i] to gj+1[i] is defined by the upsampling function U, which increases the resolution by expanding the data. A similar transformation applies to the scaling filter, where ℎj + 1[i] = U(ℎj[i]). The upsampling process, identified by U, involves inserting zeros between each element of the time series, thereby refining the signal for further decomposition. n nOnce the signals Xt and Yt undergo decomposition into J levels and their corresponding detail coefficients are extracted, QR is utilized on these wavelet details, denoted as dj[Y] and dj[X]. This procedure yields wavelet quantile regression outcomes for each decomposition level J. The WQR model for the dependent variable Y and independent variable X at a specific quantile q and decomposition scale J is specified below: n n$${ phi }_{(q)}({d}_{j}[Y]|{d}_{j}[X])={ beta }_{0(q)}+{ beta }_{1(q)}{d}_{j}[X]$$ n n(6) n nWhile the model structure aligns with Kumar and Padakandla (2022), our application adapts it to a novel empirical context—FinS modeling in a resource-rich, digitally advancing economy like Canada. Furthermore, we validate and enrich the results through the QQR approach, which allows us to visualize the nonlinear interdependencies across quantiles using heatmaps. Although the presentation format is inspired by (Liu et al., 2024), we extend its use to interpret Canadian macro-financial dynamics, a context not explored in that study. n nAlternative nonlinear methods, such as machine learning or time-varying parameter models, were considered but deemed less appropriate for explicitly capturing frequency-domain behavior and quantile-specific relationships. Thus, WQR and QQR are uniquely positioned to address the study’s objectives and data characteristics. n nFigure 2 offers an in-depth and structured depiction of the methodological framework. n nPreliminary statistics n nTable 2 outlines the observed outcomes of a statistical overview of the variables. n nThe computed mean, range, and median values for FinS, EPU, NRs, and TNI are all positive. This demonstrates that the progress of FinS is closely linked to the changes in EPU, NRs, and digitization. The current study evaluates the standard deviation of each indicator due to the significant difference in the orbit value. The level of volatility an indicator exhibits is often quantified using the standard deviation. According to this analysis, NRs exhibit the highest level of volatility among the series. Furthermore, the association between the variables is depicted in Fig. 3. n nUnit root tests n nPerforming unit root analyses on data is essential to determining the stationarity before starting time-series experiments. The present investigation utilizes the technique established by Liu et al. (2024), using the quantile Phillips-Perron (PP) and quantile Augmented Dickey-Fuller (ADF) stationarity tests. These tests vary from the standard ADF and PP tests, considering possible distributional changes at different places within the distribution rather than assuming constant distributional features throughout the whole range. This method enhances the comprehension of the data dynamics more completely (Liu et al., 2024). The results presented in Figs. 4 and 5 confirm that the variables don’t exhibit unit roots at I(0). n nBDS test n nSucceeding, by conducting Brock-Dechert-Scheinkman (BDS) test, the study assesses the non-linearity features of FinS, NRs, EPU, TNI, RQ, and INF (refer to Table 3). n nThe results demonstrated that each of the variables is nonlinear. This is evident from their substantial value at the 1% level. This outcome provides evidence for using nonlinear methodologies such as quantile regression and wavelet quantile regression. Moreover, Fig. 6 displays the theoretical quantile plot, revealing that the distributions of all variables deviate from the normal pattern. n nQuantile-on-quantile outcome n nTo capture the heterogeneous effects of NRs, EPU, TNI, RQ, and INF on Canada’s FinS, the QQR approach was employed as it is compatible with the recent literature (e.g., Kartal et al., 2024b, 2025). This method enables the exploration of how different quantiles of each explanatory variable affect various points along the conditional distribution of FinS, thereby uncovering non-linear and asymmetric relationships that standard regressions may overlook. In terms of sensitivity, the results were tested against multiple quantile grids and kernel bandwidth choices. The pattern of estimated coefficients remained stable across these specifications, confirming the robustness of the QQR results. This methodological rigor supports confidence in the quantile heterogeneity observed across all variables. n nThe association between NRs and FinS is generally positive in lower quantiles of FinS (see Fig. 7a), suggesting that during periods of weak FinS, natural resource revenues play a supportive role. This may reflect how revenue from resource exports helps stimulate capital accumulation and liquidity in Canada’s resource-driven provinces. However, between the 40th and 90th percentiles, the relationship becomes non-monotonic—fluctuating between positive and negative effects—indicating that the benefit of NRs to FinS may diminish or reverse beyond a certain economic threshold. This could reflect structural saturation in mature sectors or inefficiencies in capital reallocation during resource booms. Policymakers should note that while resource wealth supports financial development at the lower end, its impact at higher development stages may be contingent on diversification and governance capacity. n nEPU shows a small but statistically significant positive association with FinS at lower to medium quantiles (see Fig. 7b). This suggests that during relatively weaker financial periods, moderate policy uncertainty may encourage precautionary savings and regulatory responses that strengthen financial institutions. At upper quantiles, the relationship becomes stronger, reflecting Canada’s institutional resilience and the adaptive behavior of markets in responding to risk. The positive effect at higher quantiles could also indicate that well-functioning financial systems are better able to hedge against uncertainty and benefit from volatility through innovation and diversification. In this regard, Canada’s stable macro-financial framework and prudent monetary policies likely play a moderating role. n nThe effects of TNI on FinS are negative but modest at lower quantiles (see Fig. 7c), implying that in less developed financial states, technological transformation may initially displace traditional sectors or pose adjustment costs that strain existing institutions. However, from the 40th quantile upward, the relationship transitions into a strong and consistently positive one. This pattern reflects Canada’s advanced digital infrastructure and growing investment in fintech and AI-based financial services. As digital ecosystems mature, they boost financial inclusion, efficiency, and access, especially through mobile banking, digital lending, and blockchain applications. This transition underscores the importance of digital readiness and workforce re-skilling in ensuring that technological progress enhances financial resilience across all levels. n nThe results show a weak or near-zero effect of RQ on FinS at the lower quantiles (see Fig. 7d), but the relationship becomes increasingly positive and statistically significant at the higher end. This quantile-dependent behavior suggests that sound regulatory institutions exert a greater influence when the financial system is already functioning well. In Canada, where regulatory oversight is stringent and transparent—particularly in banking, insurance, and capital markets—this alignment is crucial for maintaining trust, reducing risk premiums, and supporting long-term financial development. The upper quantile responsiveness further reinforces the role of governance in sustaining financial stability under conditions of growth and innovation. n nINF exhibits a negative and significant effect at lower quantiles of FinS (see Fig. 7e), indicating that in weaker financial states, INF erodes real returns, deters saving, and increases borrowing costs—thereby weakening institutional depth. However, this effect becomes neutralized at middle to higher quantiles, reflecting Canada’s historically stable INF regime. The findings imply that well-managed INF is key to ensuring financial system functionality, particularly during early or fragile phases of development. Maintaining INF targets under 2–3% appears critical for financial sector health and capital market stability. n nWavelet quantile regression n nTo capture the time-varying and quantile-specific relationships between NRs, EPU, TNI, RQ, INF, and FinS in Canada, we apply the WQR approach, as proposed by Kumar and Padakandla (2022). WQR combines time-scale decomposition using MODWT with quantile regression to analyze the heterogeneous effects of predictors at different time horizons (short-term, medium-term, and long-term) and conditional distributions of the dependent variable. n nThis time-frequency analysis allows us to decompose the original time series into various wavelet scales (e.g., D1–D6), with D1 and D2 typically representing short-term dynamics, D3–D4 reflecting medium-term fluctuations, and D5–D6 capturing long-term structural trends. By mapping relationships across these horizons and quantiles, WQR enables deeper insights into the persistence, intensity, and asymmetry of effects that conventional models may obscure. n nFigure 8 presents the slope coefficient heatmaps across time scales and quantiles. In Fig. 8a, the relationship between NRs and FinS is shown to be negative at short and medium time scales (D1–D4) across all quantiles, albeit with weak magnitude. This suggests that in the near-to-intermediate term, resource volatility or inefficient resource governance may undermine financial system development. However, at longer horizons (D5–D6), the effect turns positive and becomes more prominent in the upper quantiles, indicating that sustained resource revenue flows and improved institutional capacity eventually enhance FinS. This supports the resource blessing hypothesis in the Canadian context, where resource management is embedded in stable fiscal and regulatory frameworks. Unlike abrupt or speculative resource use, long-term investments in financial infrastructure and capital markets from resource revenues appear to deliver structural gains. The outcome aligns with the conclusions put out by Ali et al. (2022) and Liu et al. (2024), endorsing the resource blessing theory. These findings challenge the resource curse concept, as shown by the inquiry executed by