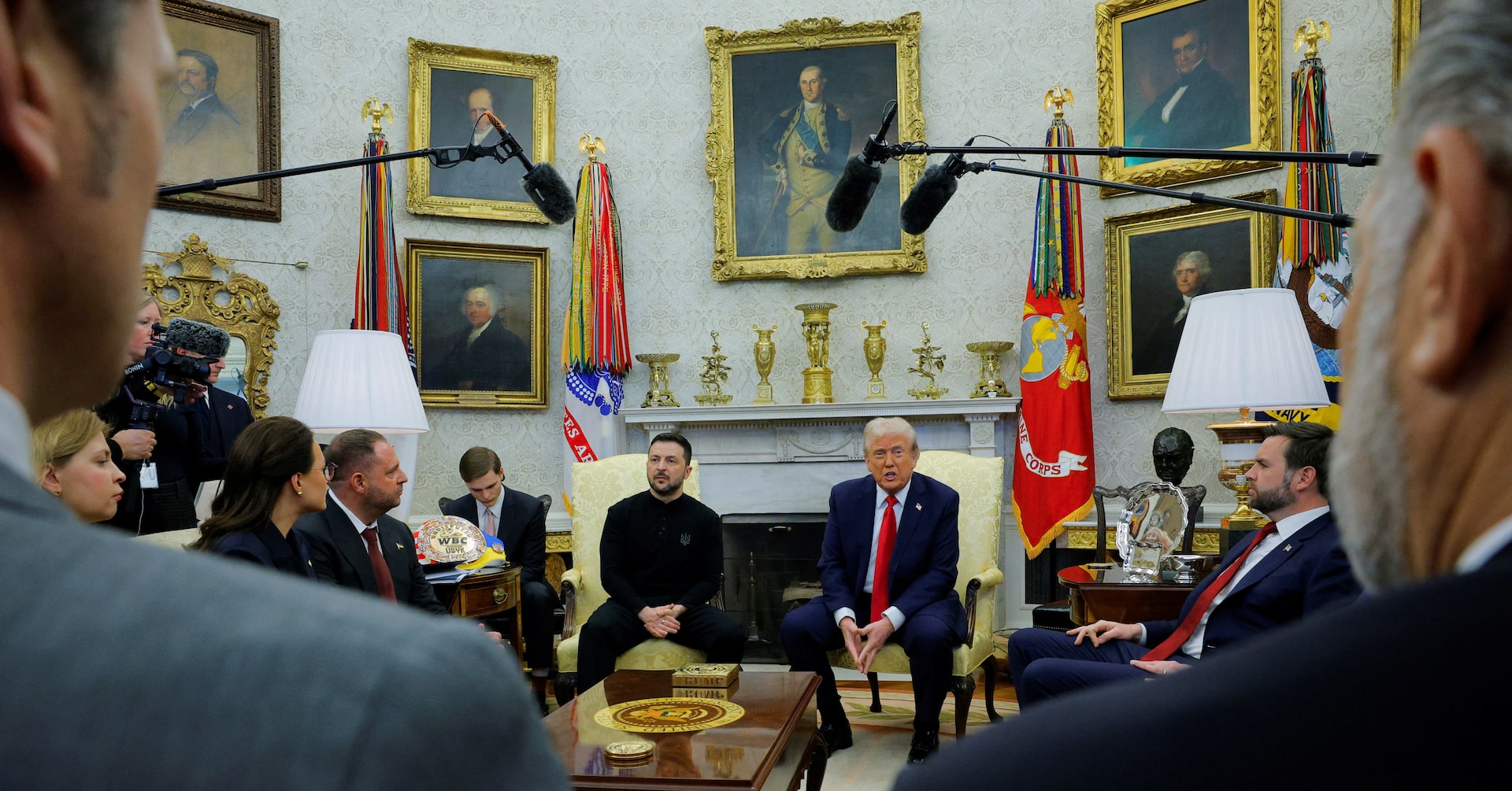

Feb 28 (Reuters) – Investors were left unsettled on Friday following a disastrous meeting between U.S. President Donald Trump and Ukrainian President Volodymyr Zelenskiy, which added uncertainty to already fragile financial markets. The meeting, which occurred against a backdrop of weakening economic data and volatility in U.S. trade policies, ended in a public exchange of words at the White House. This confrontation pushed markets toward safe-haven Treasuries as concerns grew over the potential impact on peace negotiations with Russia. “It’s disturbing,” said Jack McIntyre, portfolio manager at Brandywine Global. “It looked like progress was being made toward a peace deal or ceasefire between Russia and Ukraine, but now that may be on hold, forcing markets to factor in more uncertainty.”

Zelenskiy’s visit aimed to prevent the U.S. from aligning with Russian President Vladimir Putin, who initiated the Ukraine invasion three years ago. However, tensions flared as Zelenskiy clashed with Trump and Vice President JD Vance over the war, underscoring Kyiv’s challenges in maintaining U.S. support. Trump later accused Zelenskiy of showing disrespect to the United States. Following the heated exchange, benchmark 10-year Treasury yields, which move inversely to prices, fell to 4.23% from 4.27%.

The confrontation coincided with expectations that Trump would soon impose tariffs on key U.S. trade partners, fueling investor fears of inflation and slower economic growth. On Thursday, Trump announced plans for a 25% tariff on Mexican and Canadian goods, along with an additional 10% duty on Chinese imports, effective March 4. “The unconventional nature of the exchange highlighted the unpredictability of the Trump administration,” said Rick Meckler, partner at Cherry Lane Investments. “This added to investor concerns about a lack of predictability in U.S. diplomacy.”

Markets were already jittery after a Federal Reserve-tracked report showed slowing consumer spending last month, alongside weak consumer confidence, sluggish manufacturing, and disappointing retail and home sales. Despite the tensions, some investors remained hopeful for resolution. “Apart from the theatrics, not much changed today from a market standpoint,” said Jamie Cox, managing partner at Harris Financial Group. “Markets will rally if a constructive deal emerges after this exchange.”

— news from Reuters.com