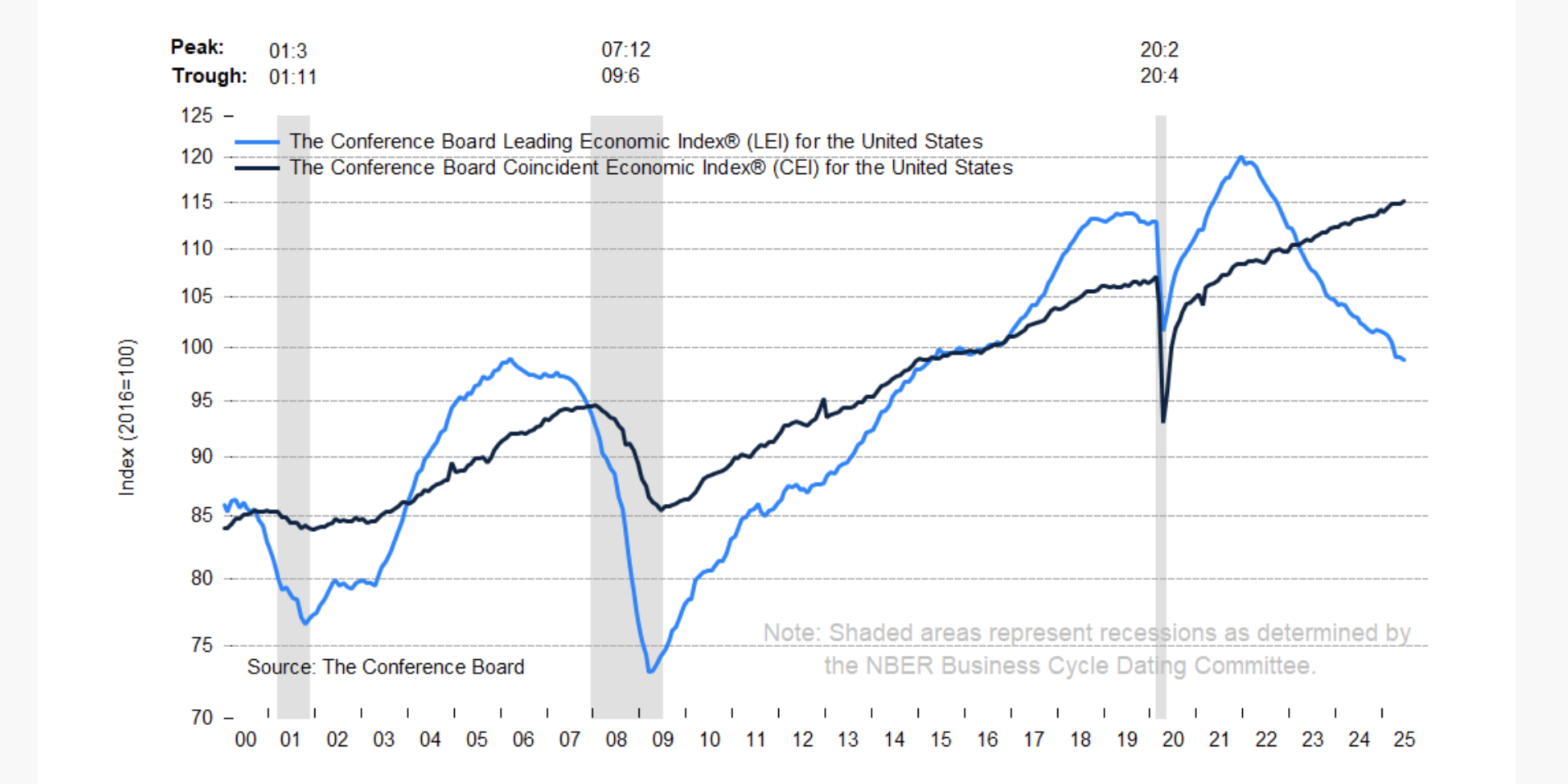

In June 2025, the U.S. Leading Economic Index (LEI) decreased by 0.3% to 98.8 (2016=100), following no change in May, which was revised upward from the initially reported -0.1%. Consequently, the LEI dropped by 2.8% during the first half of 2025, a significantly faster decline compared to the -1.3% contraction observed in the second half of 2024.

The Leading Economic Index (LEI) serves as an early indicator of significant shifts in the business cycle and provides insight into the near-term direction of the economy. The Coincident Economic Index (CEI) reflects the current state of the economy.

“The US LEI fell further in June,” stated Justyna Zabinska-La Monica, senior manager, Business Cycle Indicators, at The Conference Board. “For a second consecutive month, the stock price rally was the primary support for the LEI. However, this was insufficient to counteract persistently low consumer expectations, weak manufacturing new orders, and a third consecutive month of rising initial unemployment claims. Additionally, the LEI’s six-month growth rate weakened, while the diffusion index over the past six months remained below 50, triggering the recession signal for the third month in a row. At this point, The Conference Board does not forecast a recession, although economic growth is expected to slow significantly in 2025 compared to 2024. Real GDP is projected to grow by 1.6% this year, with the impact of tariffs becoming more evident in the second half as consumer spending declines due to higher prices.”

The ten components of the Leading Economic Index for the U.S. include:

– Average weekly hours in manufacturing

– Average weekly initial claims for unemployment insurance

– Manufacturers’ new orders for consumer goods and materials

– ISM Index of New Orders

– Manufacturers’ new orders for nondefense capital goods excluding aircraft orders

– Building permits for new private housing units

– S&P 500 Index of Stock Prices

– Leading Credit Index

– Interest rate spread (10-year Treasury bonds less federal funds rate)

– Average consumer expectations for business conditions

— News Original —

The Conference Board Leading Economic Index (LEI) for the U.S. declined by 0.3% in June 2025 to 98.8 (2016=100), after no change in May (revised upward from –0.1% originally reported). As a result, the LEI fell by 2.8% over the first half of 2025, a substantially faster rate of decline than the –1.3% contraction over the second half of 2024.

The Leading Economic Index (LEI) provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term. The Coincident Economic Index (CEI) provides an indication of the current state of the economy.

“The US LEI fell further in June,” said Justyna Zabinska-La Monica, senior manager, Business Cycle Indicators, at The Conference Board. “For a second month in a row, the stock price rally was the main support of the LEI. But this was not enough to offset still very low consumer expectations, weak new orders in manufacturing, and a third consecutive month of rising initial claims for unemployment insurance. In addition, the LEI’s six-month growth rate weakened, while the diffusion index over the past six months remained below 50, triggering the recession signal for a third consecutive month. At this point, The Conference Board does not forecast a recession, although economic growth is expected to slow substantially in 2025 compared to 2024. Real GDP is projected to grow by 1.6% this year, with the impact of tariffs becoming more apparent in H2 as consumer spending slows due to higher prices.”

The 10 components of the Leading Economic Index for the U.S. are:

Average weekly hours in manufacturing

Average weekly initial claims for unemployment insurance

Manufacturers’ new orders for consumer goods and materials

ISM Index of New Orders

Manufacturers’ new orders for nondefense capital goods excluding aircraft orders

Building permits for new private housing units

S&P 500 Index of Stock Prices

Leading Credit Index

Interest rate spread (10-year Treasury bonds less federal funds rate)

Average consumer expectations for business conditions

Click here to read the full release.

About The Conference Board