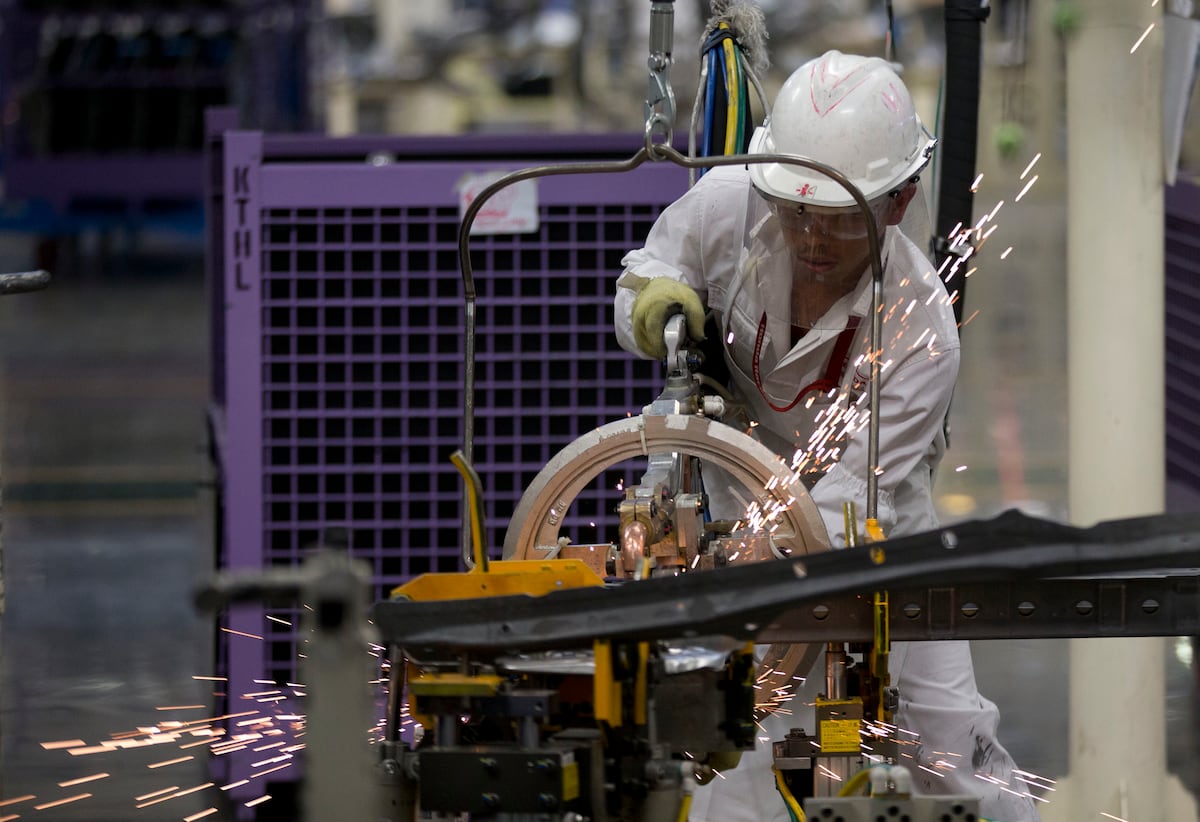

Mexico’s economic momentum has weakened significantly in the latter half of the year, as industrial production and investment continue to decline. Early data from the National Institute of Statistics and Geography (INEGI) indicates a year-on-year contraction of 0.6% for August and September. The most notable drop occurred in industrial activity, which fell by 0.3% compared to the same period in 2024, reflecting growing challenges tied to trade tensions with the United States. Despite President Claudia Sheinbaum’s promotion of Plan Mexico as a strategy to stabilize the economy, weakening performance in manufacturing, construction, and investment is undermining confidence in the country’s short-term prospects.\n\nIf confirmed, the latest figures would mark three consecutive months of economic contraction, following a 1.2% decline in July. While service-sector activity showed modest annual growth—0.4% in August and 0.8% in September—this uptick is insufficient to offset broader declines in economic output during the third quarter. INEGI’s composite indicator suggests further contraction at the beginning of the second half of 2025.\n\nLaunched earlier this year, Plan Mexico aims to counteract Donald Trump’s protectionist policies by boosting domestic production, reducing reliance on Asian imports, and deepening industrial integration within North America under the USMCA agreement. The initiative includes ambitious targets: $277 billion in investment and over 1.5 million jobs created annually. However, current economic conditions make achieving these goals increasingly unlikely. Ongoing tariff disputes, reduced federal spending, and slowing domestic demand have hindered the plan’s implementation.\n\nIgnacio Martínez Cortés from UNAM’s Laboratory of Analysis in Trade, Economics and Business, attributes the industrial downturn to uncertainty in U.S.-Mexico trade relations, particularly after the U.S. imposed a 50% tariff on steel and aluminum and up to 25% on auto exports from Mexico. “Companies are reassessing whether to maintain operations in Mexico or shift production to the United States,” he explained. Domestically, weak gross fixed investment, limited public expenditure, sluggish private consumption, and declining formal employment are exacerbating the situation. He also cited rising insecurity as a growing burden on local economies.\n\nMartínez criticized the upcoming fiscal package for failing to allocate dedicated funding to Plan Mexico, suggesting the initiative risks becoming a symbolic slogan rather than a practical roadmap to 2030. “Growth in 2026 and 2027 may still occur, but it will stem from inertia, not policy execution,” he concluded.\n\nTrade uncertainty has intensified, with the U.S. threatening to terminate the USMCA, which governs over 80% of Mexico’s exports. This, combined with Washington’s escalating protectionism, has stalled private investment. Meanwhile, Mexico faces its largest fiscal deficit in three decades—5.7% of GDP—leading to austerity measures and cuts to public infrastructure projects. Gross fixed investment has dropped 6.4% since October 2024, when Sheinbaum began her term.\n\nGabriela Siller of Banco Base expects the weakest economic performance in the second half of the year, driven by declines in manufacturing and construction. Banco Base forecasts GDP growth of just 0.4% for 2025, far below the government’s projection of 1.8% to 2.8%. International agencies are only slightly more optimistic, with some estimating a maximum 1% growth. “Consumption remains flat, investment is falling, and while exports still support growth, their contribution is waning,” Siller noted.\n\nGrupo Financiero Monex added that third-quarter 2025 growth faces headwinds from weakening secondary industries and a service sector that is slowing its expansion. Business sentiment remains negative in manufacturing, construction, and retail, though there has been a slight improvement in recent months. The final data for August will be crucial in determining the full extent of the slowdown.\n\n— news from EL PAÍS English\n\n— News Original —\nSlowdown in industrial activity and investment casts doubt on Plan Mexico’s ability to shore up the economy\n\nThe Mexican economy has lost momentum in the second half of the year, as weak investment and industrial activity complicated the country’s third quarter outlook. Preliminary figures released Tuesday by Mexico’s National Institute of Statistics and Geography (INEGI) suggest that a year-over-year decline of 0.6% is to be expected in August and September. Amid tariff uncertainty with the United States, the biggest setback last month was in industrial activity, which fell 0.3% compared to the same month in 2024. Although Claudia Sheinbaum’s government has touted its Plan Mexico’s ability to shore up the economy in the face of storm clouds, experts point to declining figures in sectors like manufacturing and construction, as well as weak public and private investment, which are casting a shadow over economic prospects heading into the final stretch of the year. \n\nIf the decline in August and September is confirmed, the country’s economic activity will have seen three consecutive months of contraction, after falling 1.2% compared to last year in July. INEGI’s economic activity indicator shows tertiary and service activities growing by 0.4% at an annual rate in August and 0.8% in September, slight increases that would not be enough to balance out losses in economic activity during the third quarter of the year. The indicator predicts that economic activity contracting at the start of the second half of 2025. \n\nSheinbaum presented Plan Mexico at the beginning of this year as her roadmap for tackling Donald Trump’s protectionist policies. Since then, her government’s commitment has been clear: to boost domestic production, increase the substitution of Asian imports, and promote greater industrial integration in North America under the umbrella of the USMCA trade agreement. The launch of the six-year strategy was accompanied by ambitious goals of attracting $277 billion in investment and creating more than 1.5 million jobs per year. Attaining those objectives seem difficult, given the current outlook. Washington’s continuous tariff attacks, reduced investment by the federal government, and the domestic economic slowdown have complicated the strategy’s takeoff. \n\nIgnacio Martínez Cortés, coordinator of the Laboratory of Analysis in Trade, Economics and Business at the National Autonomous University of Mexico (UNAM), explains that the industrial contraction expected in August and September of this year are a reflection of the uncertainty surrounding foreign trade with the United States, primarily following the imposition of tariffs on two strategic sectors: 50% on steel and aluminum and up to 25% on automobiles shipped from Mexico to the United States. “Mexico is not immune to the global impact of Donald Trump’s tariff measures, and companies are evaluating whether to continue operating abroad, in places like Mexico, or to move part of their production to the United States,” he says. \n\nDomestically, Martínez identifies a weak microeconomic outlook, with gross fixed investment failing to rebound, meager public spending, weak private consumption and finally, a decline in formal job creation. “Added to these factors is the scourge of insecurity, an element that is also taking its toll at the local level,” he says. \n\nIn regards to the role that Plan Mexico plays in reanimating the country’s economy, the expert criticized the fact that the next economic package will not allocate budget resources to the six-year plan, an oversight that makes it more of a political slogan than a feasible tool in achieving the 2030 goal. “Under these conditions, Mexico’s economy may grow in 2026 and 2027, but it will be due to its inertial attitude, not the implementation of the plan,” he concludes. \n\nIn contrast to the panorama during the last presidential administration, Mexico now faces greater uncertainty when it comes to international trade, including the United States’ threat to end the USMCA trade agreement, which covers more than 80% of Mexican exports. The uncertainty surrounding the future of trade relations between Mexico and the United States, coupled with Washington’s escalating protectionism, has brought private investment projects in Mexico to a standstill. In addition, with the largest fiscal deficit in three decades, at 5.7% of GDP, this administration has implemented an austerity plan and cut spending on public projects. Gross fixed investment, which is tracked by INEGI, shows a 6.4% drop between October 2024, the start of Sheinbaum’s six-year term, and last June. \n\nGabriela Siller, director of analysis at Banco Base, agrees that the weakest period will take place during the second half of the year, driven by a decline in manufacturing and construction. Banco Base’s own growth forecasts point to a maximum of 0.4% of GDP in 2025, far from the Treasury’s figures, which indicate an increase of anywhere between 1.8% and 2.8%. The most optimistic forecasts from international organizations point to a rise of 1% at most for the year. “We see that consumption is still stagnant, gross fixed investment is down, and although exports continue to underpin economic growth, that rise is no longer as high,” Siller adds. \n\nGrupo Financiero Monex adds that growth expectations for the third quarter of 2025 face the challenge of weak secondary activities and a service sector that is beginning to moderate the pace of its growth. “Business confidence remains in contraction territory in the manufacturing, construction and retail sectors, although there has been a slight improvement in the last three months. Looking ahead, it will be key to monitor final figures for August, as they will confirm the magnitude of the ongoing slowdown,” states the financial institution.