Irrigation organizations manage infrastructure systems including diversion structures, reservoirs, canals, ditches, and pipelines to supply water to agricultural lands. These entities typically collect fees to maintain their infrastructure through three primary pricing models: volumetric pricing based on water volume, per acre assessments or taxes, or a hybrid of both. The pricing method can influence water conservation practices on farms.

Researchers from USDA’s Economic Research Service (ERS) analyzed data from the 2019 Survey of Irrigation Organizations (SIO), a comprehensive federal data collection effort. The survey revealed that 21 percent of organizations use volumetric pricing exclusively, while 44 percent rely solely on per acre assessments. About 24 percent combine both methods, and 12 percent reported using neither.

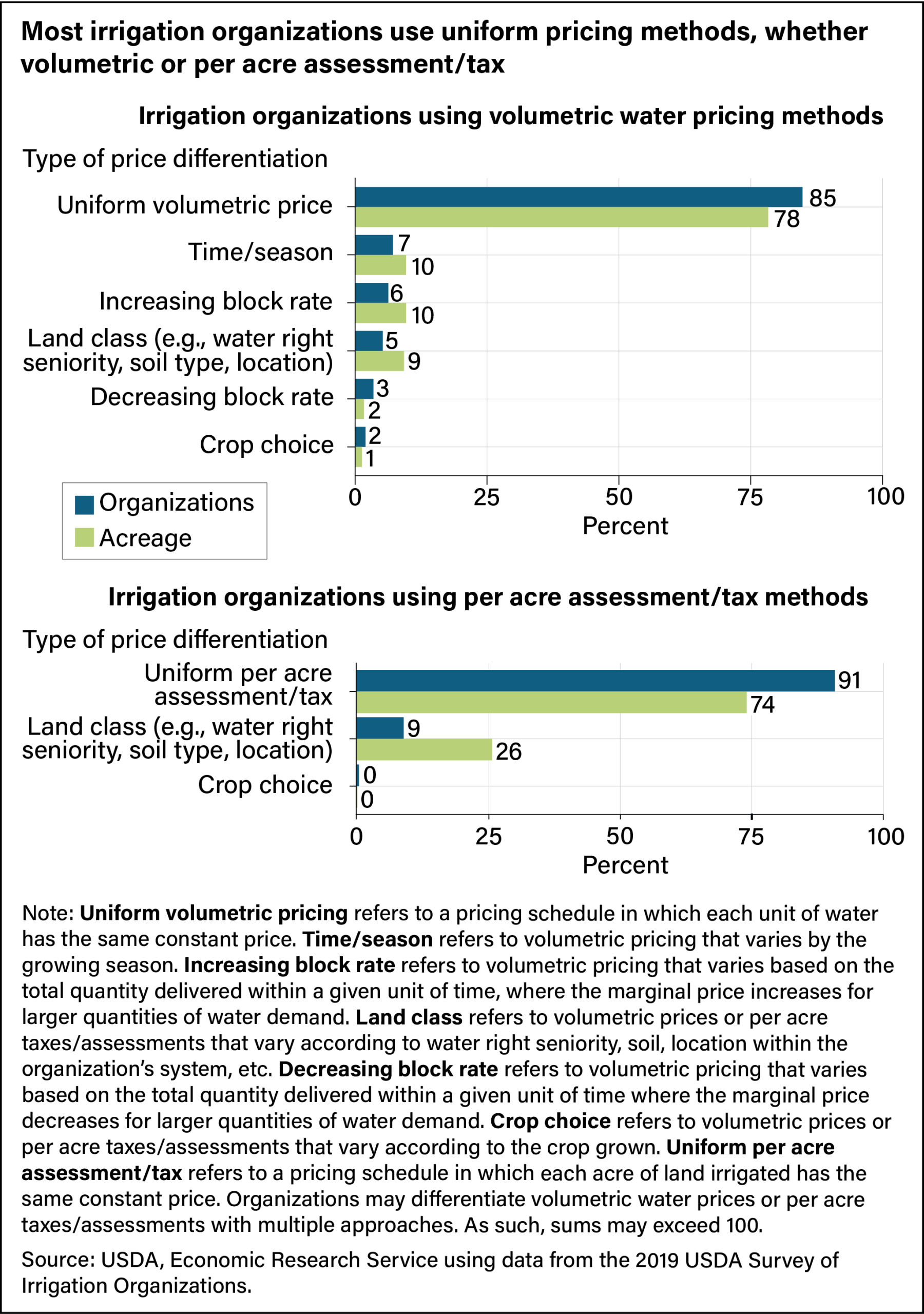

Among organizations employing volumetric pricing, 85 percent apply uniform rates across 78 percent of the total acreage they serve. Alternative approaches include seasonal pricing adjustments (7 percent of organizations covering 10 percent of acreage) and increasing block rates where higher consumption increases unit costs (6 percent of organizations covering 10 percent of acreage). The increasing block rate model potentially promotes conservation by making excessive water use more expensive.

For organizations using per acre assessments, 91 percent apply uniform rates across 74 percent of the total acreage. Among the remaining 9 percent, 26 percent of acreage experiences differentiated pricing based on land characteristics such as water rights seniority, soil type, or location. Larger organizations appear more likely to implement differentiated pricing models based on land classifications.

— news from (publisher field)

— News Original —

Irrigation organizations operate networks of diversion structures, reservoirs, canals, ditches, and pipelines to deliver water to farms and ranches. These organizations fund the maintenance of their systems through fees for water deliveries, which are generally done in three ways: volumetric pricing, which is based on the volume of water delivered; an assessment/tax per acre of land irrigated; or a combination of the two. The fee charged can determine, in part, on-farm water conservation.

To better understand how different pricing approaches are used, researchers with USDA, Economic Research Service (ERS) analyzed data from the 2019 Survey of Irrigation Organizations (SIO)—the first nationally representative Federal data collection effort aimed at organizations that deliver water to farms or influence on-farm groundwater withdrawals. Three USDA agencies (ERS, National Agricultural Statistics Service, and the Office of the Chief Economist) collaborated to develop and implement the survey.

SIO data indicate that 21 percent of organizations use volumetric pricing without any per acre assessments/taxes. The largest group, 44 percent of organizations, uses per acre assessments/taxes without any volumetric pricing. About 24 percent of organizations use a mix of volumetric pricing and per acre assessments/taxes. The remaining organizations (12 percent) do not report using volumetric pricing or per acre assessments/taxes.

The majority of organizations that employ volumetric pricing for deliveries (85 percent, or 78 percent of total acreage served by organizations that use volumetric pricing) use a uniform volumetric price (see top chart below). Two other approaches within volumetric pricing include altering prices based on time/season (7 percent of organizations, or 10 percent of total acreage) and an increasing block rate, in which more water use means an increased per unit price of water (6 percent of organizations and 10 percent of total acreage). The use of increasing block rate volumetric pricing may encourage on-farm water conservation as farms and ranches pay more per acre foot of water delivered throughout the growing season.

Of organizations that use per acre assessments/taxes (see bottom chart of figure), 91 percent (representing 74 percent of total acreage served by organizations using per acre assessments/taxes) use a uniform assessment/tax. Among the 9 percent that do not use a uniform assessment/tax, the most common form of price differentiation is altering assessments based on land class (e.g., water right seniority, soil type, location), accounting for 26 percent of the acreage subject to per acre assessments/taxes. This suggests that larger organizations, in terms of acreage served, may be more likely to differentiate per acre assessments/taxes based on land class.