By Alberto Chong and Nicolás Butrón [1]

Monitoring inflation expectations is particularly important because they can lead to self-fulfilling prophecies. If consumers expect prices to rise, they are likely to increase present consumption, boosting demand and ultimately driving up prices in the economy. This situation becomes more complex in small, open economies like ours, where a significant portion of the consumption basket is imported. Consequently, imported inflation occurs when prices rise in the countries of origin, which can translate into domestic price increases. In this context, trade agreements (TAs) between countries could serve as an indirect mechanism to ‘control’ inflation expectations. These agreements encourage foreign investment, simplify regulations, and provide better market access, potentially lowering the final prices of imported goods by reducing regulatory costs.

Do inflation expectations adjust after trade agreements are signed? This question is highly relevant given the current political climate in the United States and the current administration’s inclination to revise or abandon existing trade treaties. The absence of trade agreements could exacerbate inflation expectations, compounded by anticipated tariff increases by the U.S., complicating the global economic outlook.

Data and Methodology

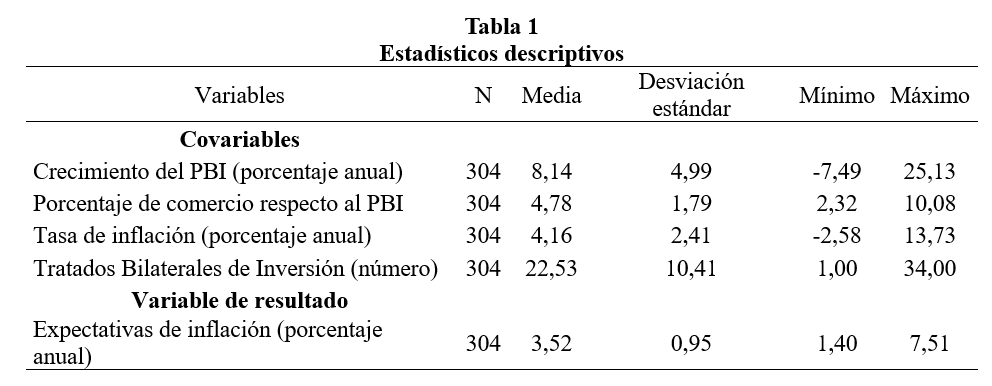

To answer this question, we applied a difference-in-differences approach using quarterly data from Peru, Chile, Colombia, and Mexico, spanning from Q4 2005 to Q3 2024. Following Chong and Srebot (2020), we exploited variations in the timing of trade agreements between the U.S. and these countries to identify causal effects on inflation expectations. We hypothesized a negative effect, as trade agreements should reduce regulatory costs, leading agents to anticipate lower prices.

What Did We Find?

Our main results, presented in Table 2, confirm our hypothesis. The implementation of trade agreements with the U.S. reduces inflation expectations among economic agents. Specifically, the coefficient for the trade agreement variable is negative and statistically significant at the 1% level. Preliminary estimates suggest that trade agreements reduce inflation expectations by 5% to 8%. Mechanisms such as reduced trade-related costs, including regulatory and protectionist costs, likely contribute to this effect by lowering imported inflation and easing inflationary pressures.

Final Considerations

Using a difference-in-differences approach, we found evidence of a causal relationship between U.S. trade agreements and inflation expectations in four Latin American countries. Trade agreements liberalize trade costs, reducing barriers like tariffs, which influence firms’ cost structures and pricing strategies. Economic agents incorporate this information, forming lower inflation expectations. This benefits inflation outcomes, as expectations are a determinant of actual inflation. Conversely, breaking trade agreements increases trade costs, raising barriers that affect cost structures and prices, thus increasing inflation expectations and worsening inflation outcomes.

— new from Foco Económico