The U.S. economy continues to demonstrate resilience, with real GDP rising 2.1% in the second quarter compared to the same period last year. Consumer spending and business investment have served as the primary engines of growth despite facing significant headwinds. For 2025, real GDP is projected to expand by a solid 2%. n nArtificial intelligence is playing a major role in driving this expansion. Business investment has been heavily concentrated in information processing equipment and software, reflecting corporate efforts to adopt cutting-edge technologies. Additionally, the surge in AI-related stock valuations is likely boosting consumer spending, particularly among higher-income and wealthier households who benefit most from equity gains. n nIn 2026, business investment is expected to remain robust as companies strive to stay at the forefront of AI innovation. A temporary boost to consumer spending is also anticipated at the start of the year, following the reopening of the federal government after a 43-day shutdown. Federal workers, who were reimbursed for lost wages, are likely to increase their consumption over the next few quarters. However, this uptick mainly offsets weaker spending during the closure and does not represent new growth. n nBeyond this initial rebound, consumer spending is expected to slow. Stock market valuations are already elevated, limiting further gains in household wealth. This, in turn, may constrain spending among high-income groups. Aggregate wage growth is also projected to decelerate as a sharp drop in net migration reduces employment growth. Moreover, businesses are increasingly passing tariff-related costs on to consumers, eroding purchasing power. n nAlthough the Federal Reserve has implemented two rate cuts this year, additional reductions are expected to occur gradually. Long-term interest rates are anticipated to decline even more slowly, leading to a steeper yield curve. This dynamic will continue to pressure business investment outside the AI sector and restrain spending on durable goods. n nUnder a baseline scenario, real GDP growth in 2026 is forecast at 1.9%. Much of this growth is expected in the first half of the year, with domestic demand slowing in the second half as the impact of back pay fades and AI-related spending and investment growth moderates. However, downside risks are significant. Given the heavy reliance on AI-driven stock performance and anticipated returns, any weakening in these areas could substantially drag on GDP. A decline in AI-related activity could even trigger a recession, especially since other sectors are already strained and unable to compensate. n nA key advantage is that the Federal Reserve retains substantial room to cut rates if needed—up to 375 basis points—providing a buffer not available in the pre-pandemic decade when rates were near zero. While such a downturn would still be painful, it suggests the economy could recover relatively quickly after an adjustment period. n— news from Deloitte

— News Original —

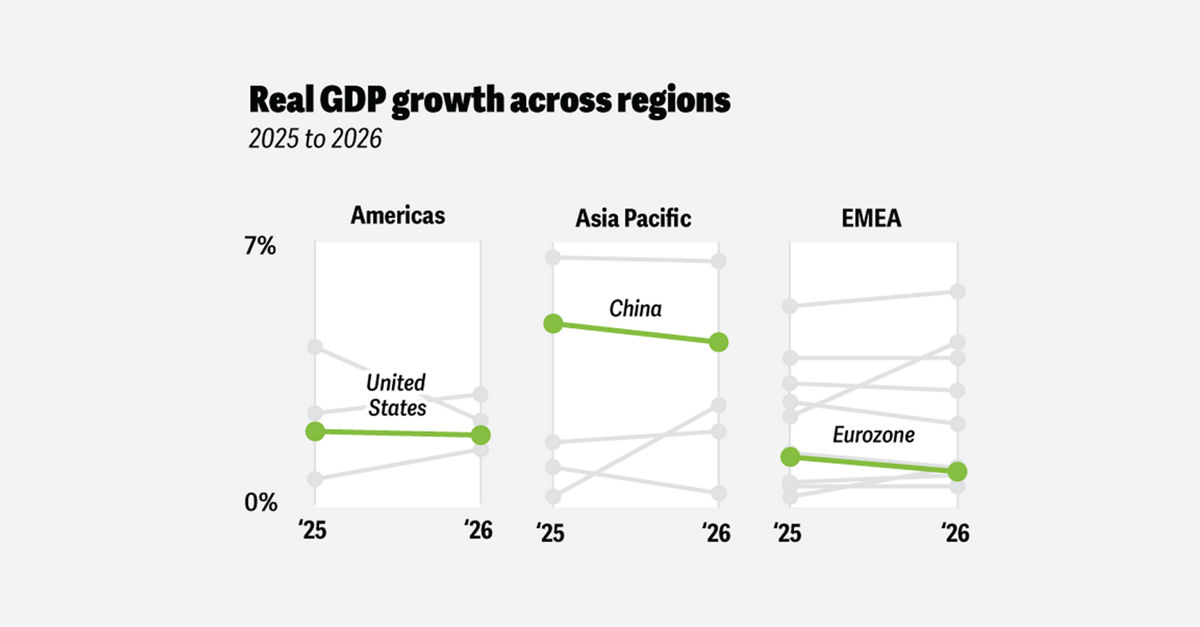

Global economic outlook 2026

United States n n– Michael Wolf n n“Resilient” continues to be the best way to describe the US economy. Real GDP was 2.1% higher in the second quarter compared with a year earlier.15 Consumer spending and business investment have been the primary growth engines despite significant headwinds. We now expect real GDP to grow by a healthy 2% in 2025. n nAI is likely fueling much of this growth. For example, business investment has been concentrated in information processing equipment and software. In addition, a dramatic rise in AI-related stock prices is likely bolstering consumer spending, especially for those at the higher end of the income and wealth distribution. n nIn 2026, we expect business investment to remain strong as companies continue to compete to be at the frontier of AI-related technological advancement. We also expect a boost to consumer spending at the start of 2026, thanks to the reopening of the federal government. Government workers who went without pay during the record 43-day shutdown have been reimbursed for their lost wages.16 Typically, this results in a boost to spending over the next couple of quarters. However, the boost in 2026 is merely making up for weaker spending during the shutdown. n nApart from the modest boost at the beginning of the year, consumer spending is expected to slow in 2026. Stock price valuations are already quite lofty,17 which will restrain gains next year. This, in turn, will likely restrain consumer spending for those at the top rungs of income distribution. At the same time, aggregate wage growth will slow further as a sharp drop in net migration holds down employment growth. In addition, businesses are increasingly passing their tariff costs on to consumers,18 which will reduce their purchasing power. n nAlthough the Fed has cut interest rates twice this year,19 we expect additional rate cuts to occur gradually. In addition, we expect longer-term interest rates to come down even more slowly, resulting in a steepening of the yield curve. This will keep downward pressure on business investment unrelated to the AI boom. It will also restrain consumer spending on durable goods. n nIn our baseline scenario, real GDP growth is expected to stand at 1.9% in 2026. Much of that growth is expected to be concentrated in the first half of the year, with domestic demand slowing in the second half as delayed compensation for federal workers runs out, while AI-related consumer spending and business investment growth shift lower. However, risks are tilted to the downside, and other scenarios could easily materialize. n nWith so much consumer spending and business investment reliant on AI-related stock prices and anticipated returns on AI, respectively, the economy remains vulnerable to any faltering of those two drivers. Just maintaining current spending levels for consumers and businesses would create a significant drag on GDP growth. A drop in AI-related spending next year could be enough to push the economy into a recession. Other parts of the economy are more strained and will therefore not be able to make up for the loss of AI-related economic activity. n nThe silver lining is that the Fed still has sufficient room to cut rates and support the economy if such a scenario plays out. This is in stark contrast to the economic environment that persisted for the decade leading up to the pandemic. During those years, interest rates were already up against the zero lower bound. Today, the Fed can cut interest rates by another 375 basis points if necessary. That does not mean the process will be painless. However, it suggests that the economy could rebound relatively quickly after an adjustment period.