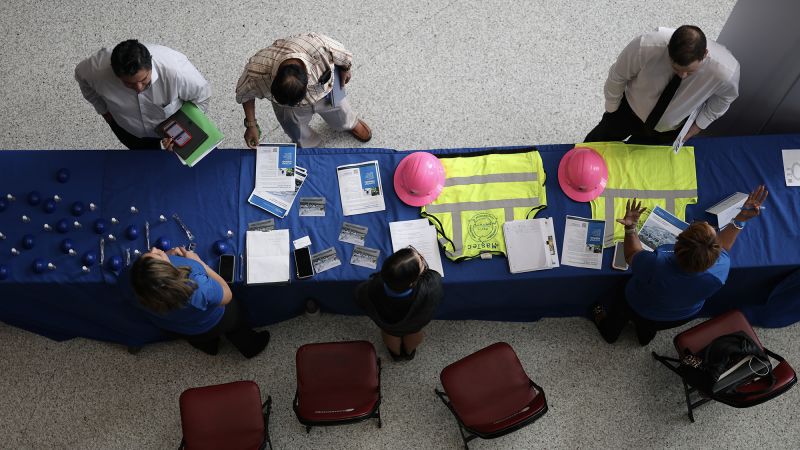

The US economy added 119,000 jobs in September, surpassing economists’ expectations of 50,000, according to data released by the Bureau of Labor Statistics after a seven-week delay due to the government shutdown. However, the unemployment rate edged up to 4.4% from 4.3% in August, marking the highest level since October 2021 and complicating the outlook for Federal Reserve policy.

The health care and social assistance sector led job growth, contributing 57,100 positions, nearly half of the total increase. Leisure and hospitality added 47,000 jobs, possibly influenced by unseasonably warm weather. Meanwhile, revised data revealed that the economy lost 4,000 jobs in August, contrary to the initially reported 22,000 gain, and July’s job additions were adjusted down by 7,000.

Despite the stronger-than-expected payroll figures, rising unemployment has fueled debate over whether the Fed will cut interest rates in December. Market expectations currently reflect a 36% chance of a rate reduction, up slightly from 33% the previous day, while a 64% probability favors holding rates steady.

Mortgage rates have climbed in recent weeks, with the average 30-year fixed rate reaching 6.26%, according to Freddie Mac, up from a recent low of 6.17%. Although the Fed does not directly set mortgage rates, its decisions influence the 10-year Treasury yield, which in turn affects borrowing costs for homebuyers.

Wall Street reacted with volatility. After an initial rally driven by optimism around AI and Nvidia’s strong earnings, major indices turned negative midday. The Dow dropped 162 points, or 0.37%, the S&P 500 fell 0.5%, and the Nasdaq declined 0.66% despite earlier gains. Nvidia shares, which had risen as much as 5%, ended down 1.2%.

Investors are closely watching inflation-adjusted wage data, expected to be released soon. In August, nominal wages rose 3.7% annually, but real wages increased by only 0.8% after accounting for inflation. The CPI showed inflation at 3% in September, up from 2.9% the prior month.

Verizon announced plans to cut 13,000 jobs—the largest single reduction in its history—as part of a transformation strategy under new CEO Dan Schulman. The company also plans to significantly reduce outsourced labor and establish a $20 million fund to help workers transition into AI-related roles.

Meanwhile, consumer behavior reflects growing price sensitivity. Target reported a 0.5% decline in average transaction size, while Walmart noted increased shopping among higher-income households seeking relief from persistent inflation. TJ Maxx attributed its success to consumers across income levels prioritizing value.

The labor force participation rate rose to 62.3% in August, up from 62.2%, with 436,000 more people entering the workforce. However, the average job search duration now exceeds six months, the longest in over a decade, indicating structural challenges in the labor market.

Economists remain divided on whether the economy is approaching stagflation—a combination of slowing growth and rising inflation. While current conditions fall short of the severe levels seen in the 1970s, the mix of elevated prices and rising unemployment has heightened uncertainty.

— news from CNN

— News Original —

Live updates: US economy saw stronger-than-expected job growth in September, but the unemployment rate rose

After a strong morning, the rally on Wall Street reversed course midday as nerves persist about expensive tech stocks and the potential for the Federal Reserve to hold interest rates steady at its policy meeting in December.

The Dow, S&P 500 and Nasdaq each turned into the red.

The Dow fell 162 points, or 0.37%, after climbing more than 700 points earlier.

The S&P 500 fell 0.5%, erasing earlier gains. The tech-heavy Nasdaq fell 0.66% after climbing as much as 2.58% earlier.

“Stocks are now deep in the red in colossal U-turn fashion,” said José Torres, senior economist at Interactive Brokers.

Nvidia (NVDA), which had helped lift the market higher, turned into the red and fell 1.2% after gaining as much as 5% earlier. The slide in Nvidia’s stock weighed on the broader market.

Meanwhile, investors wrestled with the possibility that the Fed will hold rates steady at its policy meeting in December, sapping some energy out of the market rally.

Meanwhile, bitcoin slid more than 2.6% and fell below $87,000, extending a recent tumble.

Mortgage rates have been edging higher as uncertainty grows over whether the Federal Reserve will cut rates in December. The latest jobs report has added to the confusion over when borrowing costs will be lowered.

The average 30-year fixed mortgage rose to 6.26% for the week ending November 20, according to Freddie Mac – up from this year’s low of 6.17%, reached just three weeks ago.

While the Fed doesn’t directly set mortgage rates, its decisions can affect the US 10-year Treasury yield, which mortgage rates track.

Kara Ng, a senior economist at Zillow Home Loans, said that with the federal government reopened, mortgage rates might be especially reactive to incoming economic data that had largely been on hold last month.

“The modest rate relief seen in September and October encouraged both buyers and sellers to re-engage, leading to stronger-than-expected housing activity for the season,” Ng said.

In a statement released after Thursday’s job report for September, White House press secretary Karoline Leavitt highlighted that wages for American workers rose.

While it’s true that average hourly earnings were up 3.8% in September compared to the prior year and 0.2% compared to the prior month, that doesn’t take into account the added costs Americans are facing that are captured in inflation data.

For instance, in August, despite the 3.7% annual increase in average hourly earnings, when taking into account inflation, wages were up just 0.8%, the Bureau of Labor Statistics reported.

The agency is set to release inflation-adjusted wage data for September on Friday.

Sales of previously owned homes rose last month, in a sign that lower mortgage rates are luring buyers off the sidelines.

Existing home sales, which make up the vast majority of the market, climbed 1.2% in October from the prior month to a seasonally adjusted annual rate of 4.1 million, the National Association of Realtors said Thursday, the highest level since February. It’s also the second consecutive month of rising home sales.

Mortgage rates have declined in recent months in anticipation of the Federal Reserve lowering interest rates in September and October. The average rate on a 30-year fixed mortgage reached the lowest level of 2025 in late October, and has edged higher since, according to Freddie Mac.

However, some regional markets fared better than others.

Yun also pointed out that “rents are decelerating, which will reduce inflation and encourage the Federal Reserve to continue cutting rates.”

More questions are lingering about whether the economy is experiencing stagflation after the September jobs report was released.

Stagflation refers to a scenario where economic growth is slowing substantially, which typically occurs with rising unemployment, while inflation accelerates.

Though there’s no official threshold for what determines whether an economy is experiencing stagflation, current conditions aren’t close to where they were during the 1970s and 1980s, when inflation and the unemployment rate hit double-digit levels. At the same time, the latest employment figures aren’t doing much to calm fears about stagflation.

In September the unemployment rate rose to 4.4% from 4.3% in August, the Bureau of Labor Statistics reported on Thursday. (The September jobs report was supposed to be released last month but was delayed due to the government shutdown.) Additionally, new revised data for August that the BLS reported Thursday indicates the economy shed 4,000 jobs.

Meanwhile, the annual rate of inflation rose to 3% in September from 2.9% the month prior, according to Consumer Price Index data.

The White House on Thursday touted the September jobs report as “great progress” for the US economy, highlighting gains in the private sector.

“Almost all of these new jobs were in the private sector and went to American-born workers instead of illegal aliens,” White House press secretary Karoline Leavitt wrote in a statement.

But, due to the structure of the jobs report, it is not possible to attribute employment gains to any particular demographic. While the foreign-born labor force has declined somewhat after peaking earlier this year, economists say the drop-off can be attributed to fear of answering surveys or indicating their nativity status.

The health care and social assistance sector continued to drive overall employment growth in September, adding an estimated 57,100 jobs or nearly half of the overall gains. Leisure and hospitality contributed 47,000 jobs during a month with unseasonably warm weather.

US stocks opened higher Thursday as investors embraced enthusiasm about AI and digested the September jobs report.

The Dow rose 626 points, or 1.36%. The S&P 500 gained 1.65%. The tech-heavy Nasdaq Composite rose 2.1%.

Wall Street’s fear gauge, the VIX, fell 17% as investors leaned into optimism about AI. Nvidia shares (NVDA) gained 3.7%.

The US economy added 119,000 jobs in September, although the unemployment rate ticked up to 4.4%. The better-than-expected job gains could boost arguments for the Fed to hold rates steady at its December meeting — but the higher unemployment rate complicates the picture.

Two-year Treasury yields, which can track expectations for the Fed’s benchmark interest rate, were relatively unchanged but ticked slightly lower.

“Equities (stocks) like the fact that payrolls were stronger than expected, suggesting the economy is still on a firm footing, while the bond market likes the rise in unemployment and slowdown in wage growth which may keep the case for a December Fed cut just about alive,” Seema Shah, chief global strategist at Principal Asset Management, said in an email.

Optimism about an AI boom, resilient corporate profits and hopes for lower interest rates helped stocks climb higher in recent months before a dip in recent weeks.

Wall Street is feeling better about the prospects of AI after Nvidia’s stellar earnings. Now the Fed’s interest rate policy could become more of a key focus for determining whether stocks can rebound from this recent pullback or if there’s more turbulence ahead. The S&P 500 is down 2.5% from a record high set in late October.

The long-awaited September jobs report showed revisions to previous months’ data: The Bureau of Labor Statistics reported that there were 26,000 fewer jobs added in August than the initially reported 22,000 job gains. The revised data means the economy instead shed 4,000 jobs that month.

For the month of July, the BLS also revised down the number of people hired by 7,000, bringing the total job gains for that month to 72,000.

The number of people hired each month is subject to several revisions; the first two occur in the next two months’ job reports as the government gets more data.

Investors now see a slightly greater chance that the Federal Reserve will lower interest rates again next month, after the government’s latest jobs report showed that unemployment climbed in September.

But a December rate cut is still far from a slam dunk.

Unemployment climbed in September to 4.4%, the highest level since October 2021. Unemployment generally carries more weight than job growth in the Fed’s assessment of the labor market.

Investors see a roughly 36% chance of a December rate cut, according to the CME FedWatch Tool, up slightly from 33% yesterday. The chances of the Fed holding rates steady is currently around 64%.

Fed officials are divided on how to proceed in December, with several expressing concerns about persistently elevated inflation in recent public comments and during the Fed’s October meeting, when it lowered rates for the second time this year, according to minutes from that meeting released Wednesday.

Verizon is cutting 13,000 positions — the wireless and internet company’s largest single layoff ever — marking the first initiative in the new CEO’s transformation plan.

Dan Schulman, who became Verizon’s CEO last month, said in a letter to employees Thursday that the company was overspending on staff and underinvesting on enhancing the customer experience. He said he’s making changes to “address the complexity and friction that slow us down and frustrate our customers.”

The layoffs will be extend across its entire business, he said, and Verizon will also “significantly reduce” its outsourced labor expenses. The company is establishing a $20 million fund for affected employees to focus on the “opportunities and necessary skill sets” for AI.

“The actions we’re taking are designed to make us faster and more focused, positioning our company to deliver for our customers while continuing to capture new growth opportunities,” he said.

Verizon’s sluggish customer additions has led to its stock losing a third of its value over the past five years.

Competition has also increased from T-Mobile and AT&T with the carriers battling for cost-conscious consumers with tempting deals and trade-in offers. Schulman, a former PayPal CEO, said Verizon needs to be more “scrappy” to compete against them.

Verizon has about 100,000 employees. A spokesperson said the layoffs are an “opportunity for Verizon to reset, restructure and realign our priorities in ways u200dthat will help us regain our leadership as a communications provider.”

The US economy added 119,000 jobs in September, according to data released Thursday after a seven-week delay due to the government shutdown.

That’s a huge rebound from August, when 4,000 jobs were lost, according to new data from the Bureau of Labor Statistics. The September unemployment rate moved up to 4.4% from 4.3%.

Economists were expecting 50,000 jobs to have been added and an unemployment rate that remained at 4.3%, according to FactSet.

Although the September employment data has been on the shelf since early October, it provides a critical snapshot of the labor market at a time when tariffs, stubborn inflation and elevated interest rates continue to slow the US economy.

Still-elevated interest rates, stubborn inflation and uncertainty about tariffs have made companies hesitant to hire. But they’re also reluctant to lay off their current workers.

For those without work, that equates to more time searching for a new position. The average job hunt now lasts more than six months, according to data from the Bureau of Labor Statistics. It’s the slowest hiring cycle in more than a decade.

The labor force increased by 436,000 people in August, according to BLS data. The labor force participation rate moved higher as well, ticking up to 62.3% from 62.2%.

While the majority of those labor force gains were from people classified as employed, the increase in those une mployed was largely attributed to people re-entering the labor market to search for work.

US stock futures were higher Thursday morning as investors awaited the long-delayed September jobs report.

Dow futures rose 261 points, or 0.56%. S&P 500 futures rose 1.17%. Nasdaq 100 futures gained 1.6%.

Stocks rallied in after-hours trading on Wednesday after Nvidia (NVDA), the star of the artificial intelligence boom, posted strong earnings that helped assuage nerves about a bubble.

Most markets in Asia gained after the results, signifying just how important the outcome was for sentiment about AI across the globe. Japan’s Nikkei 225 rose 2.65%. South Korea’s benchmark Kospi index gained 1.92%.

Wall Street now turns its focus to the September jobs report.

The stock market rally — up until a blip this month — has in large part been driven by optimism about Federal Reserve rate cuts. A strong jobs report could boost arguments for holding rates steady, posing trouble for stocks. Yet an unexpectedly weak report could stoke concerns about the health of the consumer, which could put pressure on companies’ profits.

Traders on Thursday were pricing in a 28% chance the Fed cuts rates at its policy meeting next month, according to CME FedWatch. That’s down from a 50% chance one week ago and a 99% chance one month ago.

CNN’s Fear and Greed Index hovered in “extreme fear.”

The resumption of the federal government’s economic data is expected to heavily influence the heated debate among America’s central bankers over whether they should continue to lower interest rates.

Federal Reserve officials were already becoming divided leading up to the longest government shutdown on record, with some of them calling for rate cuts starting in the summer to keep the labor market intact and others pointing to persistently elevated inflation as a major reason to be cautious about lowering rates.

So far, the Fed has lowered interest rates twice this year. But last month’s decision wasn’t unanimous: Kansas City Fed President Jeffrey Schmid dissented, preferring to hold rates steady, and so did Fed Governor Stephen Miran, who backed a larger, half-point cut instead. That was the first time since 2019 there were dissents for opposing reasons.

Investors currently see a roughly 67% chance of the Fed holding rates steady next month, according to futures, compared to a 33% chance of another cut.

The division among officials has spilled out into their public speeches in recent days. Fed Governor Christopher Waller in a speech earlier this week called for further rate cuts, while a few regional Fed presidents have argued the opposite.

“You may notice nothing I just said gives any guidance for our next meeting,” Richmond Fed President Tom Barkin said Tuesday at an event in Winchester, Virginia. “That’s intentional, as I think we have a lot to learn between now and then.”

As investors await a slew of official government data capturing the health of consumers, more emphasis has been placed on big-box retailers’ third-quarter earning results.

While results have varied significantly across companies, it’s clear consumers are becoming more price sensitive, and in some cases, cutting back spending.

For instance, Target reported the average transaction was down 0.5% last quarter compared to a year prior.

Meanwhile, TJ Maxx said on their earnings call earlier this week that the company’s success last quarter is owed in part to consumers across income levels looking for better prices on goods.

And Walmart’s earnings report showed that more higher-income Americans are turning to the store to seek relief from stubborn inflation.

Overall, the week’s earnings paint a picture of a cautious consumer intent on seeking out deals.