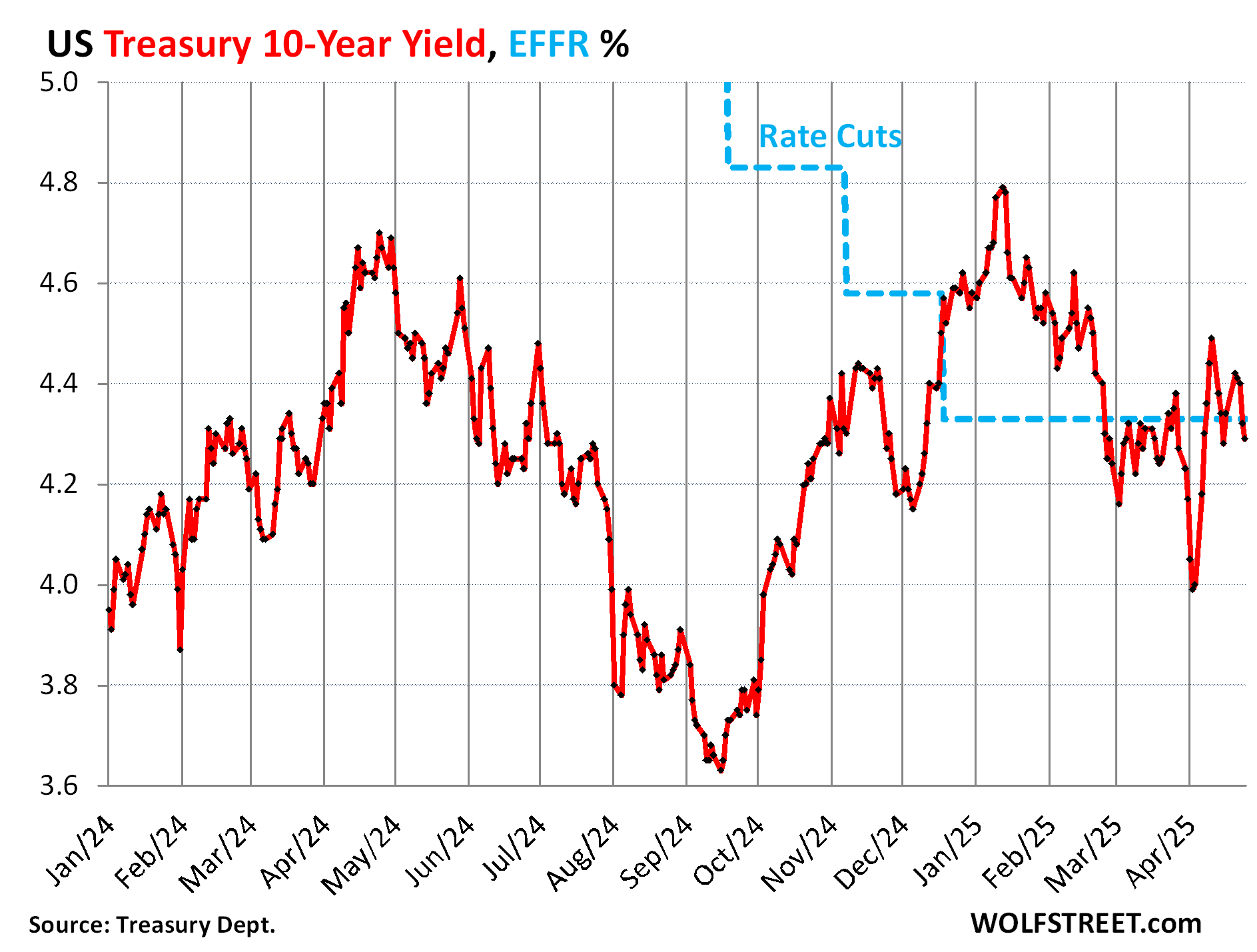

The 10-year Treasury yield fell to 4.29% on Friday, aligning with levels seen in mid-March despite fluctuations. This dip placed it below the Effective Federal Funds Rate (EFFR), currently at 4.33%. The bond market’s volatility is typical for the 10-year yield. Foreign demand for Treasuries remained strong, as evidenced by the Treasury Department’s Auction Allotment Report. Foreigners purchased 18.4% of 10-year Treasury notes in April, a significant increase from March’s 11.9%. The 30-year Treasury yield closed at 4.74%, near its three-year high. Short-term yields remain anchored by the Fed’s policy rates, with the six-month yield glued to the bottom of the EFFR. The yield curve’s middle has sagged deeply due to larger drops in yields from 1-7 years compared to longer-term yields. Treasury Secretary Bessent’s efforts to lower the 10-year yield and the dollar have been partially successful, though the dollar’s rebound has been mild. Mortgage rates remain historically high relative to the 10-year Treasury yield.

— new from Wolf Street