Braskem SA ADR shares declined by 12.75% amid a broader market downturn and ongoing operational difficulties within the chemical industry. Trading on the NYSE under the ticker BAK, the company’s stock fell from $3.11 to $2.67 over several days, reflecting investor concerns about its financial health and future outlook.

The materials sector firm reported total revenue of $77.41 billion and an enterprise value of $11.82 billion, resulting in a price-to-sales ratio of 0.45—suggesting the stock may be undervalued relative to its sales volume. However, negative equity of -$4.782 billion and total liabilities reaching $105.85 billion, which exceed total assets, raise serious concerns about leverage and solvency.

Despite a pretax profit margin of 5.3%, indicating some level of profitability, the company faces structural challenges. UBS recently downgraded Braskem’s stock due to weak sector margins and a pessimistic industry forecast, setting a revised price target of $3.80—well above the current trading level.

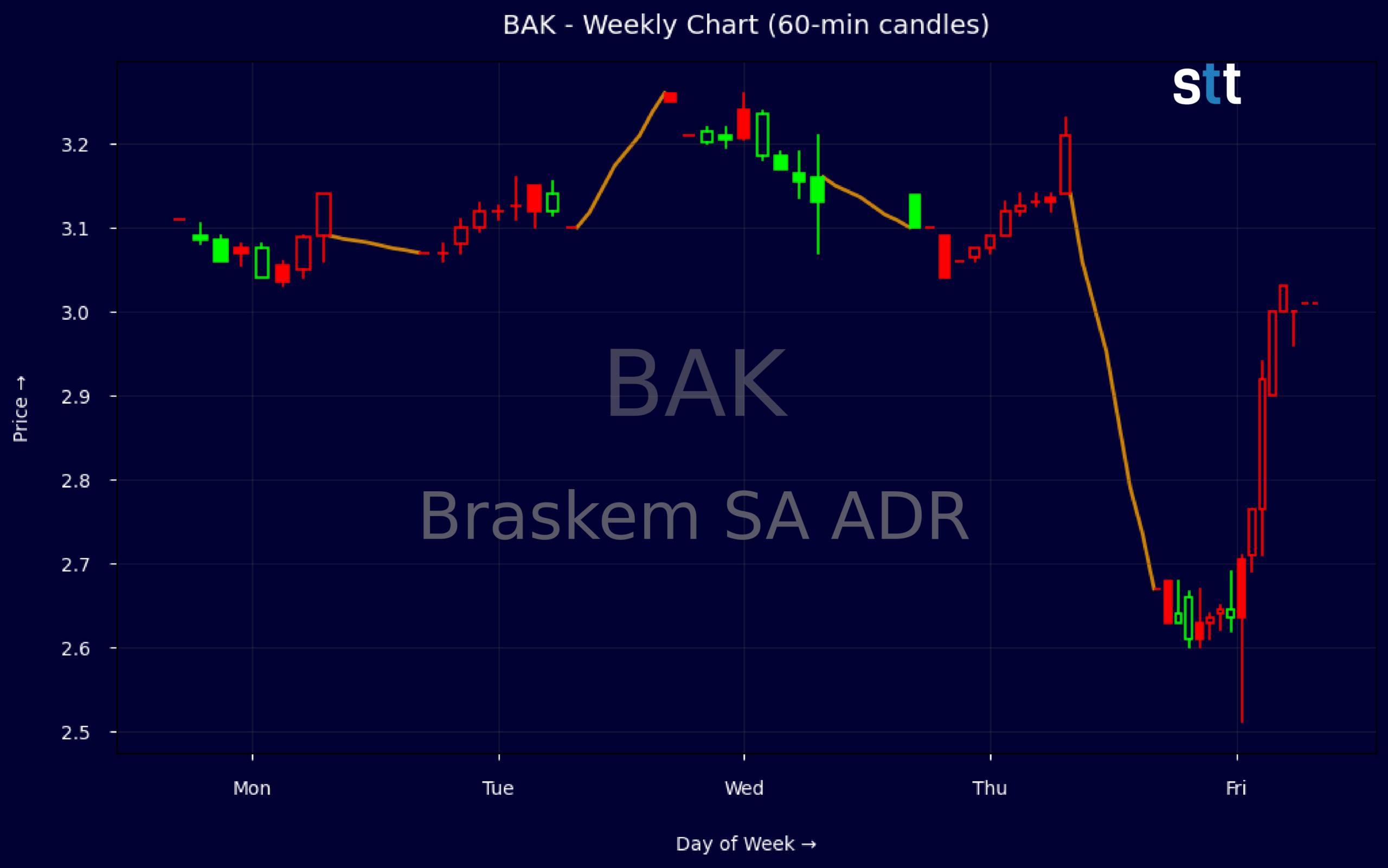

Technically, the stock shows a bearish trend with strong selling pressure near the $2.60 support level. Analysts suggest short positions could be viable, with stop-loss orders recommended just above $2.70 and potential downside targets at $2.50. Resistance is seen around $3.10, while support hovers near $2.65.

In response to mounting pressures, Braskem is reevaluating its capital structure—a move interpreted as an acknowledgment of financial stress. While the enterprise value remains substantial, declining profitability and high debt levels underscore the urgency for strategic restructuring.

The company’s efforts to explore alternative economic models reflect a proactive stance, yet the broader chemical sector continues to face headwinds. Revenue performance remains lackluster, and earnings reports have not indicated a clear path to recovery.

Market sentiment remains negative, driven by both internal financial weaknesses and unfavorable industry conditions. Although restructuring initiatives may offer a pathway to stabilization, traders are advised to proceed cautiously, focusing on defined entry and exit points rather than reacting impulsively to price swings.

As the company navigates this pivotal phase, investors will closely monitor how its financial reorganization translates into operational improvements and renewed market confidence.

— news from StocksToTrade

— News Original —

Braskem Stock Slides Amid Economic Exploration and Downgrade

Braskem SA ADR stocks have been trading down by -12.75 percent amid broader market slump and operational challenges. n nMaterials industry expert: n nAnalyst sentiment – negative n nBraskem (BAK), positioned in the Materials industry, presents complex financial fundamentals. With total revenue at $77.41 billion and an enterprise value of $11.82 billion, it shows a price-to-sales ratio of 0.45, indicating potential undervaluation relative to sales. The negative common stock equity of -$4.782 billion is concerning, though a pretax profit margin of 5.3% indicates some profitability. Total liabilities exceed total assets, raising leverage concerns with total liabilities at $105.85 billion—highlighting a need for capital restructuring to stabilize equity. n nFrom a technical perspective, weekly price movement highlights a volatile trend, starting with a high of $3.26 culminating in a drop to $2.67 by week-end. The recent price action shows significant intraday fluctuations, with a sharp decline to recent lows, suggesting bearish sentiment. The dominant bearish trend is strengthened by higher selling volumes moving down the support line of $2.60. Traders should consider short positions, maintaining a stop-loss slightly above $2.70 to hedge against potential short-term recoveries and targeting gains toward $2.50 or lower. n nRecent news indicates strategic recalibration by Braskem amidst industry challenges, with UBS downgrading the stock due to poor sector spreads and negative outlook. The company’s initiative to reconsider its capital structure suggests internal acknowledgment of financial strain, correlating with chemical sector downturns. With a revised price target of $3.80 and current price sitting lower, there’s latency for any significant recovery. Market conditions remain unfavorable, emphasizing caution with resistance pegged around $3.10 and potential support near $2.65. Sentiment remains negative due to structural challenges and weak sector forecasts. n nMore Breaking News n nIBM’s Strategic Moves: Future of Quantum n nCleanSpark Mining Decline Affects Stock n nSOUN’s Unexpected Investigations Rock the Market n nEvaxion Stock Climbs Amid Biotech Surge n nWeekly Update Sep 22 – Sep 26, 2025: On Saturday, September 27, 2025 Braskem SA ADR stock [NYSE: BAK] is trending down by -12.75%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below. n nQuick Financial Overview n nBraskem has been navigating choppy waters in the chemical industry, as reflected in its latest financial metrics. The company’s recent downtrend saw an unsettling drop from $3.11 to $2.67 over several days, marking a period of volatility likely linked to broader market conditions. Critical financial indicators reveal Braskem’s challenges, with key aspects like a price-to-sales ratio of 0.45 and a long-term debt significantly outweighing equity, pointing to an underwhelming financial health that requires redress. n nThe company’s approach to restructuring and seeking economic alternatives is a testament to its proactive stance on stabilizing its finances. Key ratios underscore a precarious profitability margin coupled with substantial liabilities that need careful management. The enterprise value remains robust at approximately $11.82B, yet it’s juxtaposed against hurdles like a declining pretax profit margin of merely 5.3%, painting a complex picture of both potential and peril. n nDespite being in an industry downturn, Braskem’s strategic maneuvers aim to turn the tide. However, the bleak revenue performance underscores the pressing need for new strategic paths to rejuvenate growth. While the earnings report hasn’t shown a promising trajectory for immediate recovery, hopes hinge on restructuring efforts to bolster operational efficacy and financial soundness. n nConclusion n nIn conclusion, Braskem finds itself at a pivotal juncture, prompted by recent downgrades and industry pressures to reassess its financial bearings. While the short-term outlook may seem cloudy, the strategic focus on restructuring presents a potential opportunity for stabilization. It is important for traders to approach Braskem’s fluctuating conditions with a mindset akin to Tim Bohen, lead trainer with StocksToTrade, who says, “I never chase price. The best opportunities allow me to enter on my terms, not when I’m feeling pressured.” The market continues to watch how these modifications might play out operationally for Braskem, especially as it seeks to regain trader confidence and realign its financial architecture amidst the prevailing challenges in the chemical sector. n nThis is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action. n nLooking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead. n nCheck out our quick startup guide for new traders! n nHow to Read Stock Charts: A Guide for Beginners n nTrading Plan: 6 Steps to Create One n nHow To Create a Stock Watchlist n nReady to build your watchlists? Check out these curated lists: n nAI Penny Stocks n nRobinhood Penny Stocks n nTop Biotech Stocks