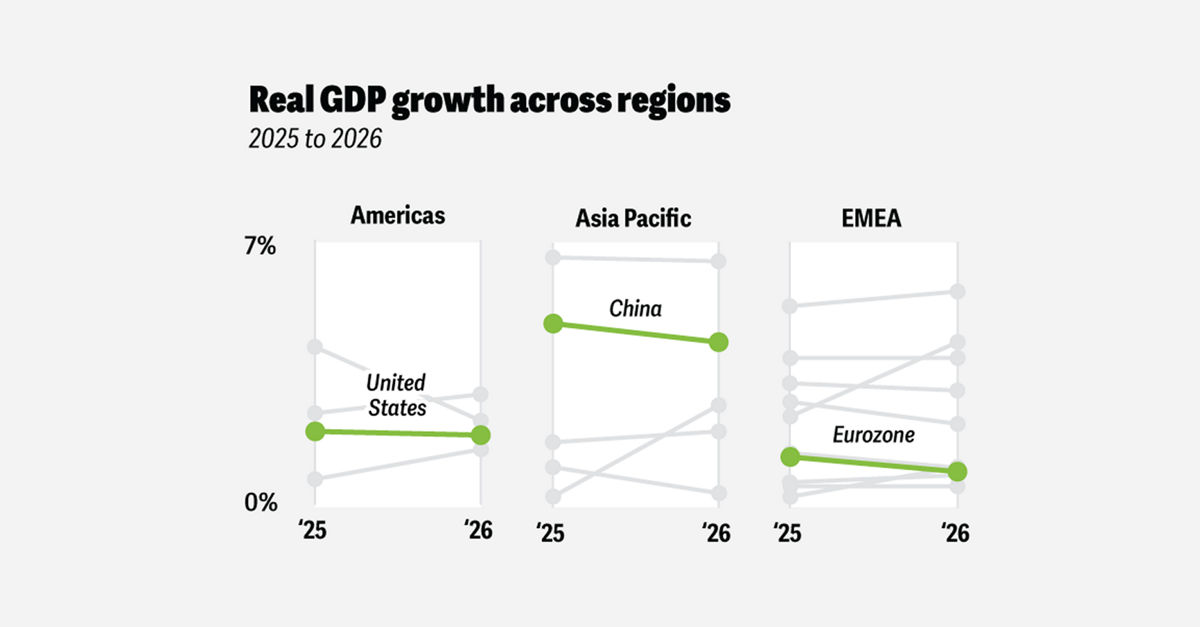

After two years of contraction, Germany entered 2025 in a fragile but gradually stabilizing state. The economy is currently navigating a mix of cyclical tailwinds, including fiscal stimulus, and persistent headwinds such as trade tensions. For now, supportive policies appear to outweigh external pressures, paving the way for a modest recovery in 2025 and stronger growth in 2026. n nFollowing GDP declines in 2023 and 2024, economic activity in early 2025 started stronger than expected, supported by front-loaded exports to the United States ahead of anticipated tariffs and a positive contribution from private consumption. However, growth slowed in subsequent quarters due to sluggish investment and ongoing international trade challenges. n nEncouraging developments emerged during the year. Price pressures continued to normalize, with headline inflation expected to ease to 2.2% in 2025 from 2.3% in 2024, supporting real incomes and household spending. The labor market also remained strong by historical standards, providing a foundation for domestic demand. n nOverall, GDP is projected to grow by approximately 0.2% in 2025, driven primarily by private consumption and government spending. However, U.S. tariffs continue to constrain exports, limiting the recovery’s breadth. Even with some clarity following the U.S.-EU trade agreement, uncertainty continues to dampen investment and consumer sentiment. n nIn 2026, economic conditions are expected to improve modestly, with fiscal policy playing a central role. A portion of a 500-billion-euro multiyear infrastructure package—focused on public construction—and increased defense spending are expected to boost growth through public investment and government consumption. However, implementation delays and bureaucratic hurdles mean the full impact will unfold gradually. n nAdditional measures, including energy price relief starting January 1, 2026, and a mid-2025 business investment incentive, are expected to further support industrial activity. Yet structural reforms remain essential to enhance Germany’s long-term competitiveness. n nPrivate consumption is expected to remain a positive contributor, supported by solid—though moderating—wage growth and a slightly improving labor market. Export activity remains weak but should begin a gradual recovery as global trade tensions ease, despite persistent structural challenges in the industrial sector. n nAltogether, Germany’s economy is projected to grow by 1.2% in 2026. The pace of recovery depends on effective policy execution and progress in addressing long-standing issues related to bureaucracy, energy costs, and social security. Geopolitical deterioration or renewed trade policy disruptions pose risks, while a peace agreement between Russia and Ukraine could accelerate growth. n nWhile the downturn appears to have ended, Germany’s path to a self-sustaining and dynamic recovery will likely require deeper political reforms and strategic investments. n— news from Deloitte

— News Original —

Global economic outlook 2026

Germany n n– Alexander Börsch and Pauliina Sandqvist n nAfter two consecutive years of contraction, Germany entered 2025 in a fragile but gradually stabilizing position. Currently, the economy is caught between cyclical tailwinds (fiscal policy) and headwinds (tariffs). At present, it seems most likely that tailwinds will outweigh headwinds, resulting in a minor recovery in 2025 and stronger growth in 2026, supported by fiscal measures. n nFollowing GDP declines in 2023 and 2024, 2025 began surprisingly well, with modest economic activity.52 Front-loaded exports to the United States, in anticipation of tariffs, supported growth, while private consumption provided a positive impulse too. In the following quarters, economic activity slowed again, mainly due to headwinds from international trade and sluggish investment. n nHowever, there are also some encouraging developments in 2025. One such development is the continued normalization of price pressures. Headline inflation is expected to ease to 2.2%53 in 2025 from 2.3% in 2024, improving real incomes and supporting household spending. Also, the labor market has remained robust by historical standards. n nOverall, GDP is projected to grow by around 0.2%54 in 2025. The main drivers are private consumption and government spending. Nevertheless, US tariffs continue to dampen exports, limiting the scope of recovery. Even if uncertainty has partly cleared since the US-EU trade deal, it is still dragging investment levels and consumer sentiment. n nNext year, economic conditions are expected to improve modestly, with fiscal policy playing a pivotal role. A moderate portion of the 500-billion-euro multiyear infrastructure package (mainly flowing into public construction investments) and substantial additional defense spending (visible in public equipment investments and government consumption) will likely boost the pace of growth. n nHowever, implementation delays and bureaucratic hurdles mean that the full impact will only materialize gradually. Yet additional investments alone are not enough for sustainable impact; structural reforms remain necessary to strengthen Germany’s long-term competitiveness. Next to the fund, planned energy price relief (starting Jan. 1, 2026), alongside the investment booster for businesses introduced in mid-2025, will further support economic activity, especially in the industrial sector. n nPrivate consumption should continue to contribute positively, supported by robust, albeit moderating, wage growth and a slightly improving labor market. Export activity remains subdued but should begin to recover gradually, as structural challenges in Germany’s industrial sector presumably persist, but the drag from global trade tensions eases slightly. n nAltogether, the German economy is projected to grow by 1.2%55 next year. However, the pace of improvement hinges on effective policy implementation and progress in addressing long-standing challenges in bureaucratic burden, energy, and social security systems. A worsening of the geopolitical context and renewed trade policy turmoil pose further risks to this forecast. On the other hand, a peace agreement between Russia and Ukraine would likely lead to stronger growth momentum. n nWhile the downturn appears to be over, Germany’s path to a self-sustaining and dynamic recovery will likely require political reforms and strategic investments.