The Week Ahead Economic Preview for 23 June 2025 highlights critical global economic trends and events. Flash PMI surveys will provide insights into business morale amid rising geopolitical tensions. Economists are particularly focused on the impact of tariff uncertainties and escalating oil prices on global economic growth. Key regions such as the US, eurozone, UK, Japan, Australia, and India will release early PMI data, offering clues about current and future output growth. Additionally, inflation data from the US and Canada, along with consumer confidence surveys, will shape expectations for monetary policy. Other notable events include Germany’s Ifo Business Climate report, the UK’s GDP update, and central bank meetings in Thailand and Mexico.

— News Original —

Week Ahead Economic Preview: Week of 23 June 2025

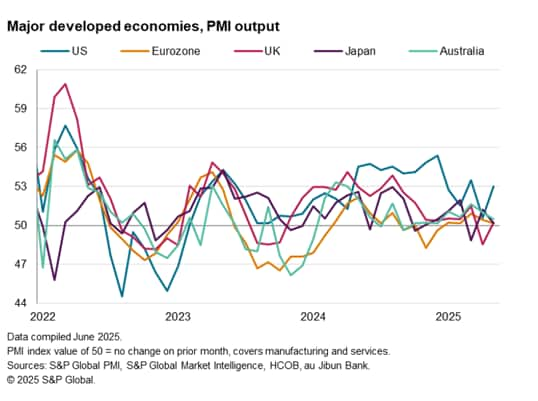

The following is an extract from S&P Global Market Intelligence’s latest Week Ahead Economic Preview. For the full report, please click on the ‘Download Full Report’ link. Flash PMI surveys to gauge business morale amid rising global tensions. Early PMI survey data for the US, eurozone, UK, Japan, Australia and India will provide eagerly awaited insights into global economic trends and business confidence in June. The data have been collected as ongoing tariff uncertainty has been exacerbated by escalating tensions in the Middle East. The global PMI data for May signalled improvements in terms of current and expected future output growth worldwide. The rebound in future expectations was especially pronounced, linked to easing concerns over US tariffs. Steep tariff rises announced in early April had been paused later that month. However, with these pauses on higher-rate tariffs due to lapse in early July, the survey data have generally remained subdued by long-run standards amid heightened uncertainty (see chart), adding fuel to expectations of weak global economic growth this year. Moreover, with tensions rising in the Middle East, pushing oil prices sharply higher, the flash PMI data will be keenly assessed to see whether April really represented “peak gloom” in terms of business confidence, or whether executives consider the economic and political environment to have deteriorated further. The surveys have nonetheless picked up some bright spots. Stronger output gains have notably been seen in the US service sector and eurozone manufacturing, the latter buoyed by expectations of greater fiscal spending (particularly in Germany). UK growth also lifted higher in May to assuage downturn fears, and the June data will be important to gauge any impacts from the US-UK trade deal, April’s tax rises and recent government spending review. The spike in oil prices meanwhile threatens to drive inflation higher. Brent Crude has risen almost 10% on average so far in June compared to May. These higher oil prices come after the May PMI surveys showed a broad disinflationary trend in much of the world, though notably bar the US and Canada, where tariffs had reportedly pushed up firms’ costs and fed through to higher selling prices. The upcoming release of fresh official inflation data for both the US and Canada will therefore also be keenly awaited during the week and will help steel expectations of monetary policy, as will consumer confidence surveys from both the Conference Board and University of Michigan, and US trade data, the latter to be eyed for the impact of tariffs. PMI surveys showed the US outperforming compared to broadly stagnant growth in Europe, Japan and Australia in May, though even in the US the pace of growth was much weaker than seen on average in 2024.

— news from S&P Global