WASHINGTON (AP) — According to a recent analysis by the Congressional Budget Office (CBO), President Donald Trump’s tax cuts package is projected to increase federal deficits by $2.8 trillion over the next decade, accounting for broader economic impacts. The report, prepared in collaboration with the Joint Committee on Taxation, highlights that the bill would raise interest rates and add $441 billion in additional interest payments on federal debt.

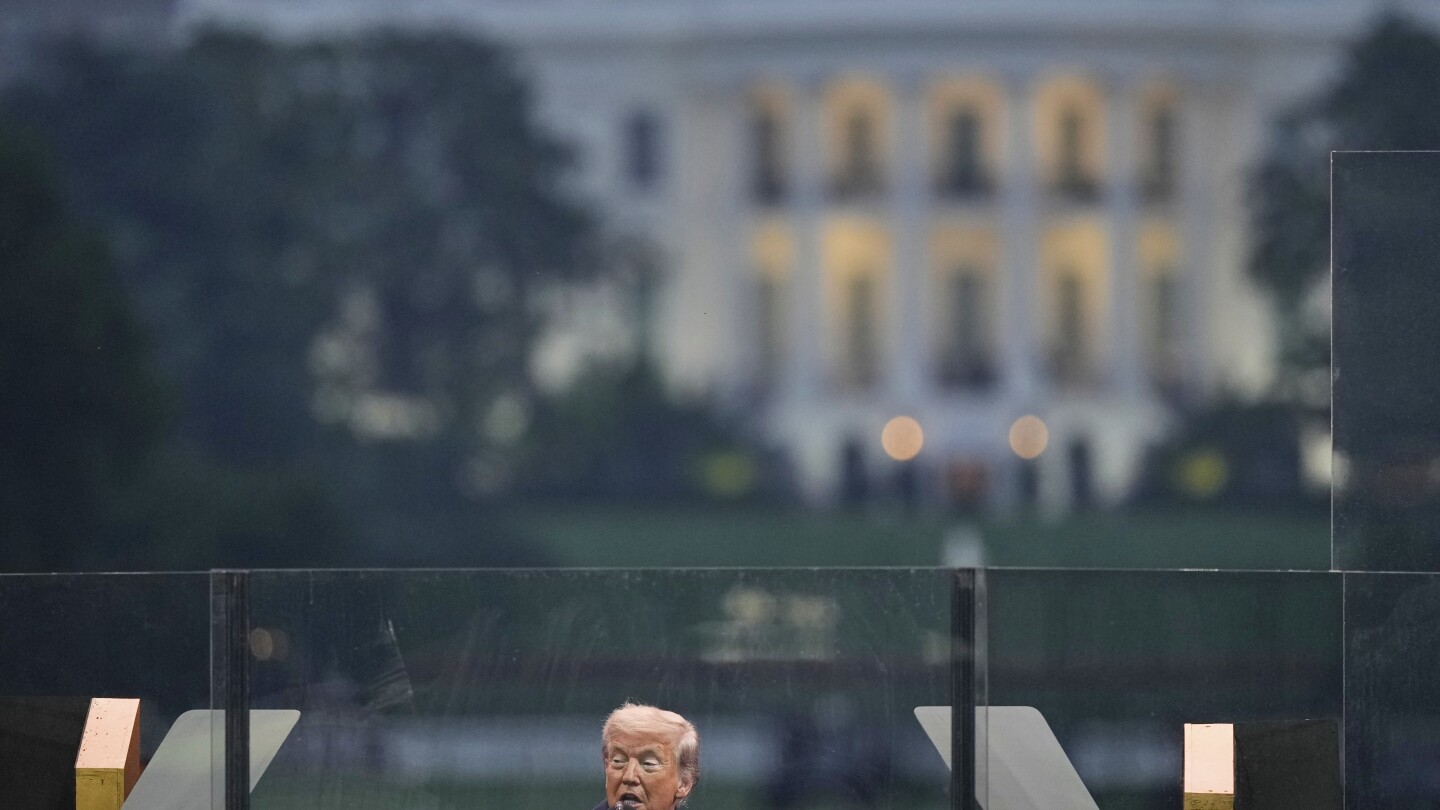

The findings come as the Trump administration urges Congress to finalize the legislation, which passed the House last month. Senate Majority Leader John Thune expressed optimism about advancing the bill after discussions with Vice President JD Vance. The CBO’s dynamic scoring approach considers how economic changes could influence government revenues and spending, contrasting with static models that assume no economic shifts.

An earlier CBO report estimated the bill would increase deficits by $2.4 trillion and result in 10.9 million more people losing health insurance. Republicans argue that tax cuts will stimulate economic growth, offsetting revenue losses, but critics, including Democrats, dispute this claim. Sen. Jeff Merkley criticized the bill, emphasizing its potential to exacerbate national debt. Treasury Secretary Scott Bessent and other GOP members have questioned the CBO’s methodology, arguing it underestimates economic benefits.

The Senate’s version of the bill includes deeper Medicaid cuts and expanded tax breaks for seniors, while maintaining the current $10,000 cap on state and local tax deductions, a point of contention among lawmakers. Negotiations are ongoing as both chambers aim to reconcile differences.

— new from AP News